Global Bonds Decline Amid Tariff Concerns and Their Impact on Portfolios

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Global Bonds Decline Amid Tariff Concerns and Their Impact on Portfolios

Introduction

Recent tariff threats have reignited fears of a trade war, leading to a notable selloff in global bonds. This development has significant implications for investors, as it highlights the interconnectedness of geopolitical events and market dynamics. In this article, we'll explore how these tariff concerns are affecting global bonds, the broader market implications, and how traders can use MarketVibe's metrics to navigate these turbulent waters.

Current Market Sentiment

The market sentiment is currently neutral, but the rising tensions from tariff threats are creating an undercurrent of uncertainty. Investors are wary, as these geopolitical developments can quickly shift market dynamics, impacting both confidence and stability. Understanding how these factors interplay is crucial for making informed investment decisions.

Global Bond Market Reaction

The global bond market has reacted sharply to the renewed tariff threats, with Treasuries joining a broader selloff. This reaction is driven by concerns over fiscal spending and the potential economic impact of escalating trade tensions. As tariffs increase the cost of goods, they can lead to inflationary pressures, prompting investors to reassess the risk-reward balance in holding bonds.

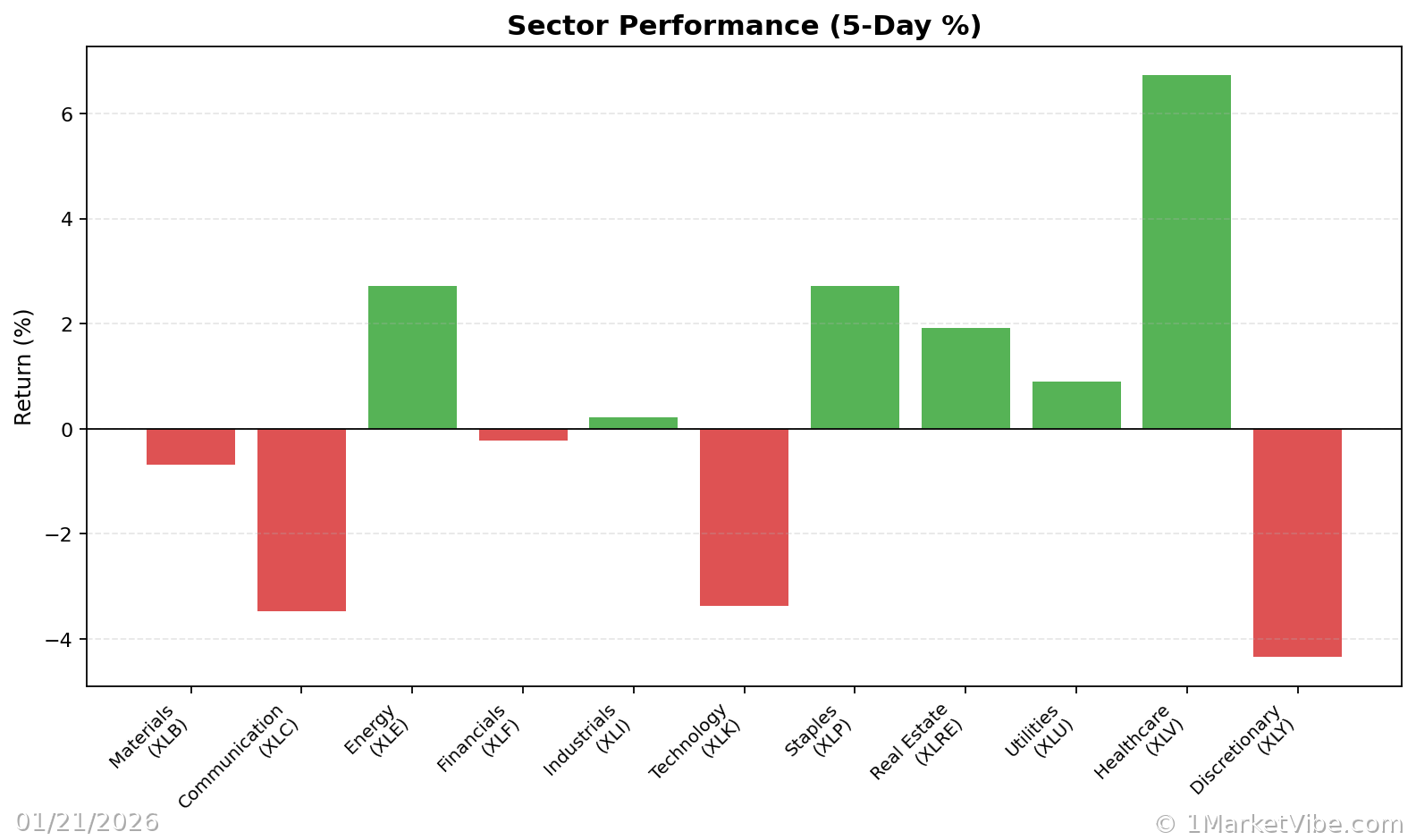

Stock Market Implications

The stock market has also felt the impact of tariff news, with pullbacks observed across various indices. The ongoing tensions can lead to prolonged uncertainty, affecting stock valuations and investor sentiment. Companies reliant on international trade may face margin pressures, which could weigh on their stock performance.

Geopolitical Factors

Geopolitical events, such as tariff threats, play a significant role in shaping market dynamics. President Trump's recent tariff threats have added a layer of complexity to the market landscape, influencing both bond and stock markets. Traders need to be aware of these developments and consider their potential long-term effects on their portfolios.

Investor Strategies

In navigating tariff-induced volatility, investors should focus on risk management. This involves adjusting position sizes, diversifying across sectors, and considering hedging strategies. By staying informed and flexible, traders can better manage the risks associated with geopolitical uncertainties.

CW Index Insights

The Crash Warning Index (CWI) is a valuable tool for assessing market risk. Currently, the CWI reading is at 5.9, indicating elevated risk levels. The CWI is a composite metric that considers various risk dimensions, including breadth, volatility, and defensive behavior. When the CWI is above 6, it suggests that corrections are more likely, and traders should adopt a defensive posture.

Interpretation of CWI Levels

- Below 3: Low risk, conducive to risk-taking.

- 3 to 6: Neutral to elevated risk, warranting caution.

- Above 6: High risk, suggesting potential for market corrections.

Understanding these ranges helps traders align their strategies with the prevailing market conditions. For instance, when the CWI is high, reducing exposure to high-risk assets and focusing on defensive sectors can be prudent.

Real-World Scenarios

Scenario 1: Topping Environment

In a topping environment, the market index may continue to rise while underlying breadth deteriorates. This scenario often precedes a correction, as seen when the % Above 50-DMA declines even as the index grinds higher. Traders might feel tempted to chase the rally, but a more informed view would emphasize caution and risk management.

Scenario 2: Bull Leg Surge

During a strong new bull leg, the % Above 50-DMA can surge and remain elevated, indicating robust market health. In such cases, traders can consider increasing exposure to leading sectors, provided their setups align with broader market trends.

Scenario 3: Volatility Spike

A sudden increase in volatility, reflected by a spike in ATR%, can signal an unstable market phase. This often coincides with rising CWI levels, prompting traders to reassess their risk exposure and possibly employ hedging strategies to protect their portfolios.

How to Use This Insight in a Process

To effectively incorporate these insights into your trading process:

- Monitor CWI Levels: Use the CWI to gauge market risk and adjust your risk posture accordingly.

- Assess Breadth and Volatility: Check the % Above 50-DMA and ATR% to understand market health and volatility regimes.

- Use the Market Dashboard: Leverage the Decision Edge dashboard to get a high-level view of market conditions and confirm with internal metrics.

Common Misuses & Misconceptions

- Treating CWI as a Stand-Alone Signal: The CWI should guide your risk posture, not dictate specific trades.

- Ignoring Context: Always consider sector rotation and broader market trends when interpreting metrics.

- Overreacting to One-Day Changes: Focus on sustained trends rather than reacting to daily fluctuations.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.