Fed's Record Repo Usage Stabilizes Year-End Markets

As we step into the new year, the Federal Reserve's record use of its repo facility has played a pivotal role in stabilizing the financial markets at year-end. This article will delve into the mechanics of the repo facility, its historical context, and how it interacts with MarketVibe's Crash Warning Index (CWI) to provide insights into market stability and risk.

Understanding the Repo Facility

Repo Facility Explained

The repo facility, or repurchase agreement facility, is a tool used by the Federal Reserve to manage short-term interest rates and ensure liquidity in the financial system. In a repo transaction, the Fed buys securities from financial institutions with an agreement to sell them back at a later date. This process injects liquidity into the banking system, helping to stabilize funding markets.

Historically, the repo facility has been used during periods of financial stress to prevent spikes in short-term interest rates. The recent record usage indicates the Fed's proactive stance in maintaining market stability as the year closed.

Current Market Conditions

Funding Market Dynamics

At the end of 2025, the financial markets were characterized by tight liquidity conditions, often seen during year-end periods due to balance sheet constraints on banks. The Fed's increased repo operations helped alleviate these pressures, ensuring that short-term interest rates remained stable.

Impact on Market Sentiment

The Fed's actions have had a calming effect on market sentiment. By providing ample liquidity, the repo facility has reduced the risk of funding squeezes, which can lead to broader market volatility. This stability is reflected in MarketVibe's metrics, particularly the Crash Warning Index (CWI).

CW Index Insights

Connection Between Repo Usage and CWI

The Crash Warning Index (CWI) is a composite metric that assesses market risk by analyzing breadth, volatility, and defensive behavior. The CWI currently reads 5.53, indicating moderate risk. This level suggests that while risks are present, the market is not in immediate danger of a significant downturn.

The Fed's repo actions are a stabilizing factor, contributing to a lower CWI by ensuring liquidity and reducing volatility. This alignment between the Fed's actions and CWI signals provides traders with a clearer picture of the market's underlying health.

Risk Assessment

Moderate Risks in the Market

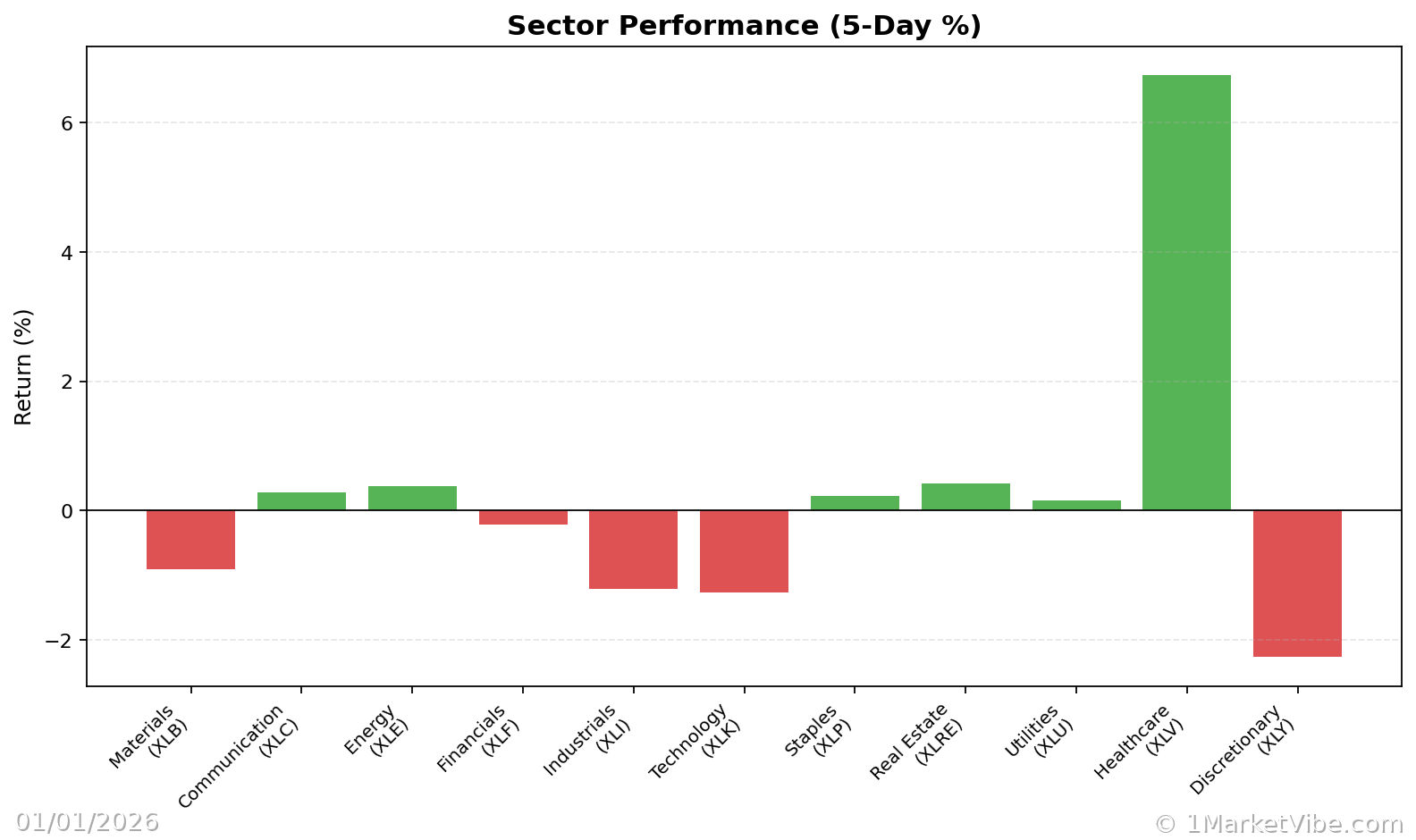

Despite the stabilizing effect of the repo facility, several factors contribute to a perception of moderate risk. These include geopolitical tensions, economic data releases, and sector-specific challenges. Traders should remain vigilant, as these factors can influence market dynamics quickly.

Implications for Investors

Investment Strategies and Caution

For investors, the current market environment suggests a balanced approach. With the CWI indicating moderate risk, it's prudent to maintain a diversified portfolio and consider hedging strategies to protect against potential volatility spikes.

Example Scenarios

Topping Environment: Imagine a scenario where major indices are reaching new highs, but the % Above 50-DMA is declining. This divergence could signal a weakening trend, prompting traders to reduce exposure and tighten risk management.

Bull Leg Surge: In a strong bull market, the % Above 50-DMA might surge above 70%, indicating robust breadth. In such cases, traders might consider increasing exposure, provided their setups align with broader market trends.

Volatility Spike: If ATR% jumps significantly, indicating increased volatility, traders might be tempted to exit positions. However, a more informed approach would involve assessing the CWI and breadth metrics to gauge whether this is a temporary spike or a sign of deeper market instability.

How to Use This Insight in a Process

- Monitor Breadth and CWI: Use MarketVibe's Decision Edge dashboard to keep an eye on breadth metrics and the CWI. When breadth is weak and CWI is high, emphasize defense and reduce new risk.

- Adjust Exposure: When breadth and leadership broaden out, you can be more open to adding exposure, provided your setups are there.

- Use Market Dashboard: Employ the Market Dashboard as a high-level regime label, then check internals for confirmation.

Common Misuses & Misconceptions

- Stand-Alone Signal: Traders often misuse the CWI as a stand-alone entry signal. Instead, it should be part of a broader risk assessment framework.

- Ignoring Context: Overlooking sector rotation and time frame can lead to misinterpretation of metrics. Always consider the broader market context.

- Overreacting to Daily Changes: One-day changes in metrics can be misleading. Focus on trends and sustained movements for a clearer picture.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.