Chip Shortages Drive 20% Price Increase and Their Impact on Tech Portfolios

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Chip Shortages Drive 20% Price Increase and Their Impact on Tech Portfolios

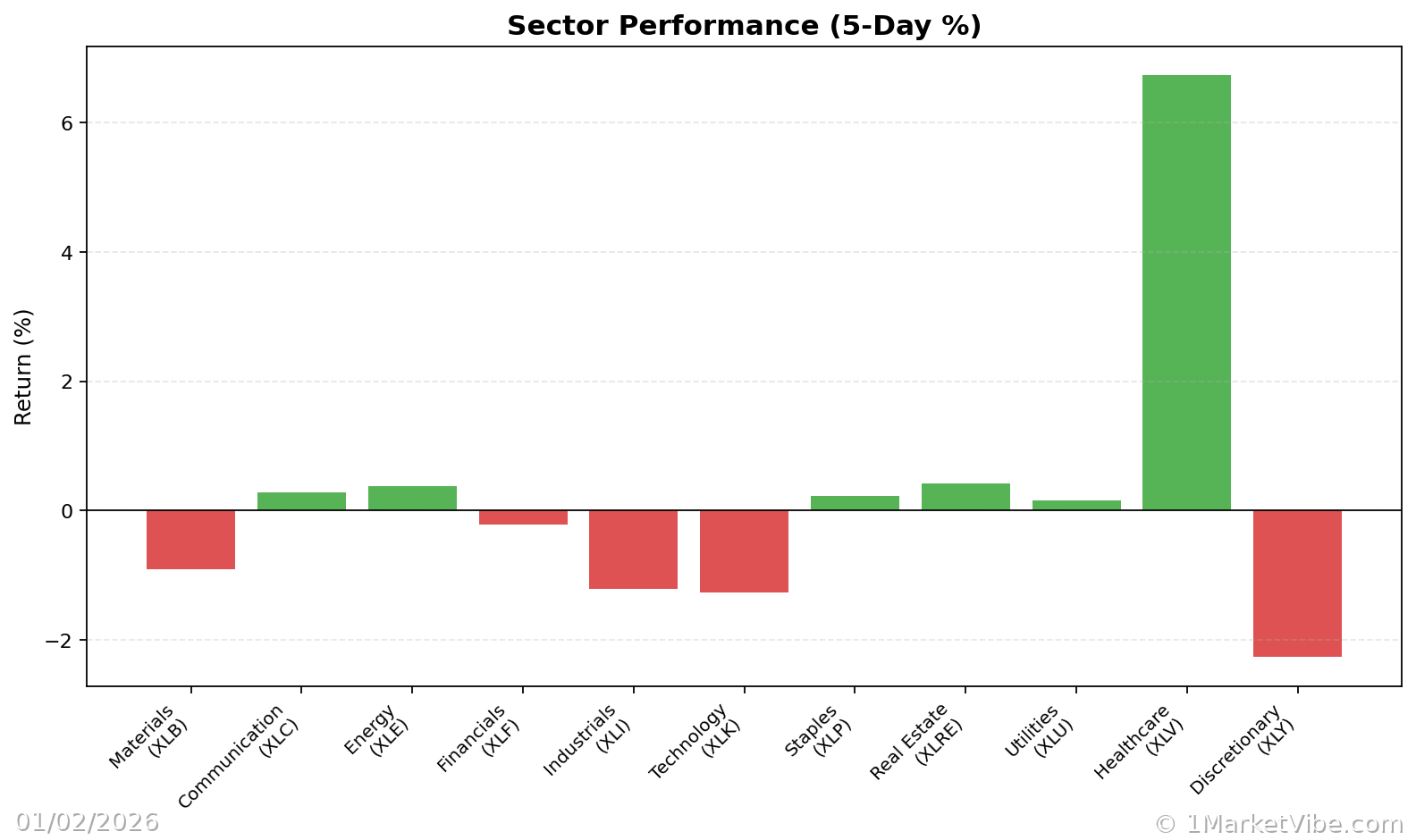

The global semiconductor shortage has been a persistent issue impacting various sectors, particularly technology. As we enter 2026, the situation has intensified, leading to a projected 20% increase in consumer electronics prices. This article explores the underlying dynamics of the chip shortage, its implications for tech-heavy portfolios, and how traders can use MarketVibe's metrics to navigate these challenging conditions.

Understanding the Current Market Dynamics

Semiconductor Demand and Supply Chain Disruptions

The demand for semiconductors has surged due to the rapid expansion of AI data centers and the increasing integration of chips in consumer electronics. This demand has outpaced supply, exacerbated by supply chain disruptions. These disruptions are not just logistical but also involve geopolitical tensions and production bottlenecks, further straining the availability of semiconductors.

Price Implications

The direct consequence of this imbalance is a projected 20% increase in the prices of consumer electronics. This price hike is expected to affect consumer spending patterns, potentially slowing down the adoption of new tech products. For investors, this means recalibrating expectations for revenue growth in tech companies that rely heavily on consumer electronics sales.

Impact on Tech Portfolios

Risks and Considerations

For investors with tech-heavy portfolios, the rising costs and market volatility present significant risks. The increased prices could lead to reduced consumer demand, impacting the earnings of tech companies. Additionally, the volatility in the semiconductor market can lead to unpredictable stock movements, affecting portfolio stability.

Using MarketVibe Metrics to Navigate Risks

To manage these risks, traders can leverage MarketVibe's metrics such as the Crash Warning Index (CWI), % Above 50-DMA, and ATR%. These tools provide insights into market breadth, volatility, and risk conditions, helping traders make informed decisions.

Crash Warning Index (CWI): Currently reading at 5.53, the CWI suggests elevated risk levels. A CWI above 6 typically indicates heightened correction risks, prompting traders to consider defensive strategies.

% Above 50-DMA: This metric measures the percentage of stocks trading above their 50-day moving average, indicating trend health. A low percentage suggests market weakness, while a high percentage indicates strength. Monitoring this can help traders assess the underlying market trend.

ATR%: This measures volatility relative to price. High ATR% values indicate choppy or unstable market phases, while low values suggest quieter trends. Understanding volatility regimes can guide traders in adjusting their risk exposure.

Real-World Scenarios

Scenario 1: A Topping Environment

Imagine a scenario where the market index continues to rise, but the % Above 50-DMA begins to decline. This divergence often signals weakening breadth, suggesting that fewer stocks are participating in the rally. Traders might feel tempted to chase the rising index, but a more informed approach would be to reduce exposure and prepare for potential corrections.

Scenario 2: A Strong Bull Leg

In a strong bull market, the % Above 50-DMA surges and remains elevated, indicating robust market participation. In this environment, traders can consider increasing exposure, provided their setups align with broader market strength.

Scenario 3: Volatility Spike

A sudden increase in ATR% coupled with a rising CWI can signal a volatility spike. This often leads to rapid market swings, tempting traders to react impulsively. However, understanding these metrics allows for a more measured approach, emphasizing risk management and strategic positioning.

Incorporating Insights into a Trading Process

Practical Guidelines

When breadth is weak and CWI is high, emphasize defense and reduce new risk. This might involve tightening stop-loss levels or reducing position sizes.

When breadth and leadership broaden out, be open to adding exposure, but only if your setups are there. This ensures alignment with market strength.

Use the Market Dashboard as a high-level regime label, then check internals for confirmation. This holistic approach helps in aligning trading strategies with prevailing market conditions.

Common Misuses and Misconceptions

Traders often misuse these metrics by:

Treating them as stand-alone entry signals: It's crucial to use them as part of a broader analysis framework.

Ignoring context: Metrics should be interpreted in light of sector rotation and broader market conditions.

Overreacting to one-day changes: Focus on trends and sustained movements rather than daily fluctuations.

A healthier approach involves integrating these metrics into a comprehensive trading process, using them to guide risk posture and expectations rather than precise timing.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: The information provided here is for educational purposes only and should not be considered as financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.