Wealthy Cash Flow Shifts and Their Implications for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Wealthy Cash Flow Shifts and Their Implications for Investors

December 15, 2025 – In a significant financial shift, wealthy Americans are increasingly moving their cash out of traditional checking and savings accounts. According to recent data, high-income households have reduced their bank balances by an average of 15% over the past year, reallocating these funds into alternative investments such as real estate, private equity, and cryptocurrencies. This trend is reshaping the landscape of market liquidity and investment strategies.

Why It Matters

For investors, this shift signals a potential decrease in market liquidity as substantial amounts of cash exit traditional banking systems. This movement could impact lending rates and the availability of capital for investments, leading to broader market implications. The immediate effect is a heightened risk of volatility, as sudden changes in cash flow patterns can disrupt financial stability. MarketVibe's CW Index, currently at 5.18, reflects a moderate risk environment, suggesting that these shifts were somewhat anticipated by early warning signals.

Context & Background

Historically, similar cash reallocations have occurred during periods of economic uncertainty or when alternative investments promise higher returns. The current trend is driven by low interest rates on savings accounts, prompting wealthy individuals to seek better yields elsewhere. Key stakeholders affected include banks, which may face challenges in maintaining liquidity, and sectors like real estate and tech, which are seeing increased investment inflows.

Market Liquidity Implications

- Decreased Liquidity: As cash exits banks, liquidity in the financial system may tighten, affecting lending and borrowing conditions.

- Investment Availability: Reduced bank deposits could limit the funds available for loans, impacting sectors reliant on credit.

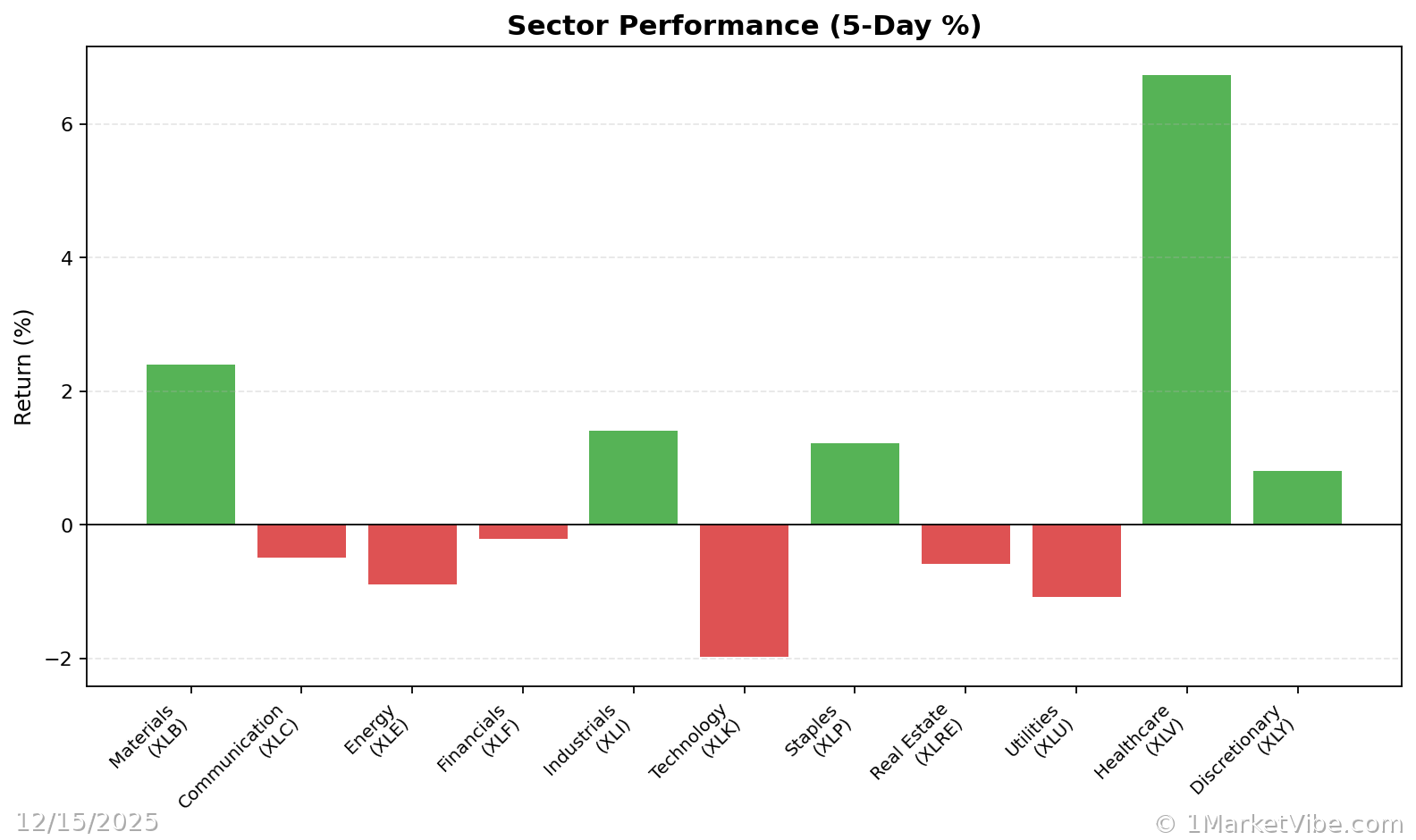

- Sector Performance: Real estate and tech sectors may benefit from increased investment, while traditional banks could face pressure.

Investment Trends Analysis

Emerging sectors such as renewable energy and technology are attracting significant interest from wealthy investors. This mirrors past trends where shifts in cash flow led to booms in specific industries. Investors should note that while these sectors offer potential growth, they also come with increased risk due to market volatility.

CW Index Insights

MarketVibe's CW Index provides a lens into the current risk environment, with a reading of 5.18 indicating moderate risk. This aligns with the observed cash movement trends, offering investors a tool to gauge potential market shifts and adjust their strategies accordingly.

Potential Risks

- Market Volatility: Sudden shifts in investment patterns can lead to increased market volatility, affecting portfolio stability.

- Economic Stability: Long-term effects of reduced bank liquidity could challenge economic stability, influencing interest rates and inflation.

Conclusion

The ongoing trend of wealthy individuals moving cash into alternative investments is reshaping market dynamics. Investors should monitor these developments closely, as they could have significant implications for liquidity and sector performance. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.