Ford's EV Strategy Shift and Its Implications for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Ford's EV Strategy Shift: A $19.5 Billion Writedown and Its Implications for Investors

Breaking News: Ford Motor Company has announced a staggering $19.5 billion writedown on its electric vehicle (EV) investments as of December 16, 2025. This strategic pivot comes amid shifting market dynamics and regulatory landscapes, marking a significant recalibration in Ford's approach to the burgeoning EV sector.

Market Reaction

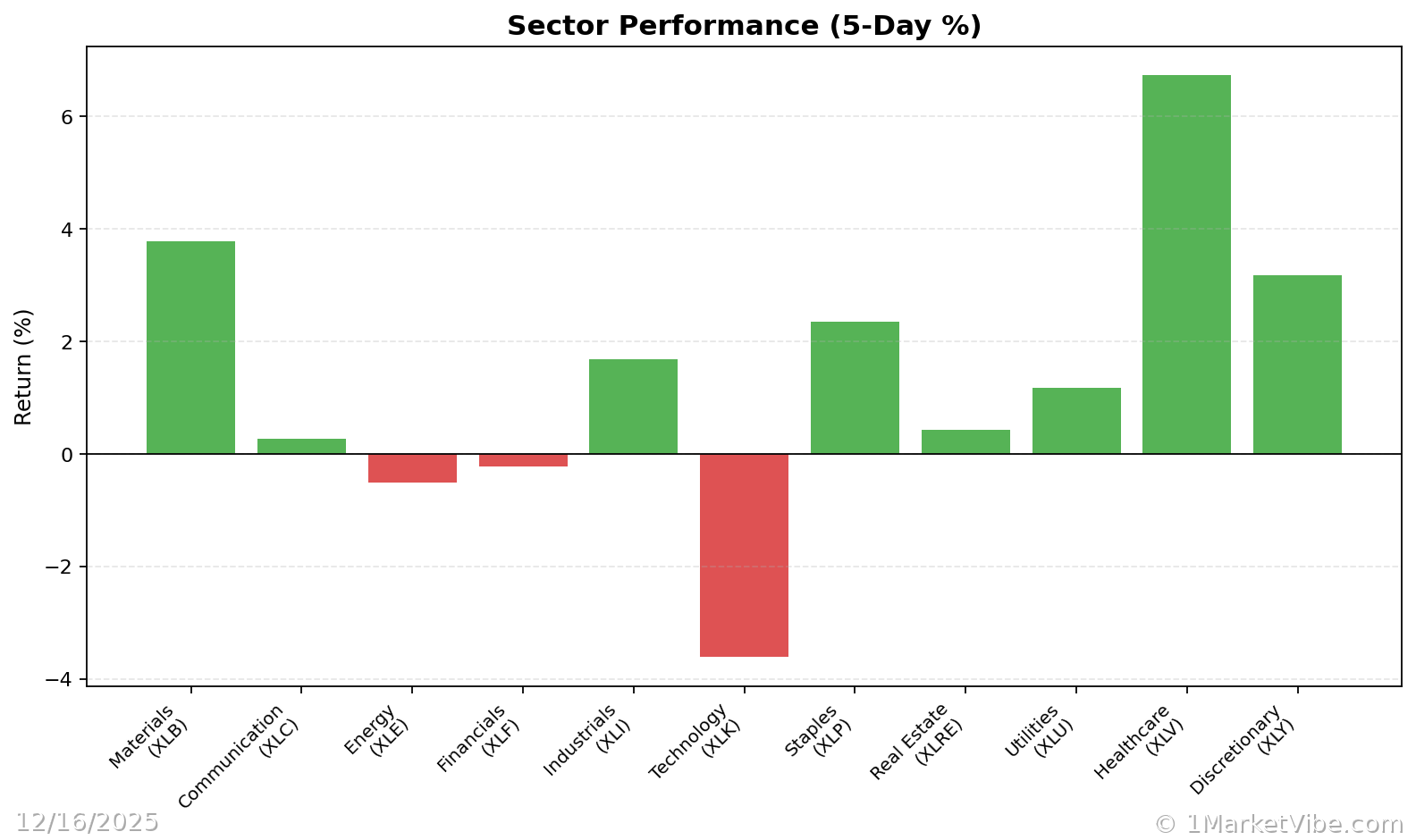

The announcement sent ripples through the market, with Ford's stock experiencing a 2.5% drop in pre-market trading. This move reflects investor concerns over the company's ability to navigate the competitive EV landscape. The broader market also reacted, with the S&P 500 and Nasdaq Composite showing minor declines as investors reassess their positions in the automotive sector.

Why It Matters

For investors, this writedown signals potential volatility in the EV market. Ford's decision underscores the challenges traditional automakers face in transitioning to electric vehicles amidst evolving consumer preferences and regulatory pressures. The writedown could lead to a reevaluation of Ford's long-term growth prospects, impacting portfolio strategies for those heavily invested in automotive stocks.

- Immediate Impact: Ford's writedown may prompt other automakers to reassess their EV strategies, potentially leading to broader market adjustments.

- Broader Implications: This shift highlights the importance of adaptability in the face of regulatory changes and technological advancements.

Context & Background

Historically, large corporate writedowns have often preceded strategic shifts aimed at long-term sustainability. Ford's move follows similar actions by other automakers grappling with the high costs of EV production and supply chain constraints. The decision is partly driven by the need to align with global regulatory standards and consumer demand for sustainable vehicles.

Key stakeholders affected include:

- Investors: Facing potential shifts in stock valuations and dividend policies.

- Suppliers: Adjusting to changes in production demands and material sourcing.

- Consumers: Anticipating changes in product offerings and pricing strategies.

Supply Chain Concerns

The strategic importance of securing critical minerals for EV production cannot be overstated. Recent investments, such as Korea Zinc's $7.4 billion plant, underscore efforts to stabilize supply chains. Ford's writedown may accelerate similar investments, as automakers strive to mitigate risks associated with material shortages.

Historical Context

Past market reactions to corporate writedowns have varied, often depending on the perceived long-term benefits of the strategic shifts. Investors typically exhibit cautious optimism, balancing short-term losses against potential future gains. This pattern may repeat as Ford realigns its EV strategy.

Current Market Sentiment

MarketVibe's CW Index, currently at 5.89, reflects a neutral sentiment surrounding Ford's announcement. This reading suggests that while investors are cautious, they are not overly pessimistic about Ford's future prospects. The index's early warning capabilities indicate that this trend was somewhat anticipated, providing a buffer against market shock.

Investor Considerations

For investors, the key takeaway is the heightened risk associated with the EV sector. Strategies to consider include:

- Diversification: Reducing exposure to automotive stocks to mitigate sector-specific risks.

- Hedging: Employing options or other financial instruments to protect against potential losses.

- Monitoring: Keeping a close eye on regulatory developments and Ford's strategic updates.

Conclusion

Ford's $19.5 billion writedown marks a pivotal moment in the company's EV journey. As the market digests this news, investors should remain vigilant, monitoring how Ford's strategy evolves in response to regulatory and market pressures.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.