CW Index at 5.57: Navigating Uncertainties Surrounding Fed Rate Cuts

- Authors

- Name

- MarketVibe Team

- @1marketvibe

CW Index at 5.57: Navigating Uncertainties Surrounding Fed Rate Cuts

As the Federal Reserve continues to deliberate on potential rate cuts, the financial markets are on edge. Understanding the implications of these decisions is crucial for investors looking to navigate the current economic landscape. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.57. This reading is below the 7.0 warning threshold, indicating a moderate risk level. This index serves as a vital tool for investors seeking to anticipate market movements and adjust their strategies accordingly.

Learn more about how CW Index works at 1marketvibe.com

Current Economic Landscape

Recent economic indicators, including fluctuating trade balances and shifting employment figures, paint a complex picture. The U.S. economy is feeling the impact of global trade dynamics, particularly with China's trade surplus reaching over $1 trillion despite ongoing tariffs. This has contributed to the uncertainty surrounding the Fed's monetary policy decisions. MarketVibe's CW Index suggests that these developments were foreseeable, offering investors a strategic advantage in planning their next moves.

Fed's Rate Cut Speculations

The Federal Reserve's discussions on rate cuts have been a focal point for market participants. Statements from Fed officials indicate a divided stance, with some advocating for cuts to stimulate growth, while others caution against potential inflationary pressures. Market expectations remain volatile, as investors weigh the likelihood of rate adjustments. According to MarketVibe data, the CW Index at 5.57 reflects this uncertainty, highlighting the importance of monitoring these developments closely.

Investment Strategy Considerations

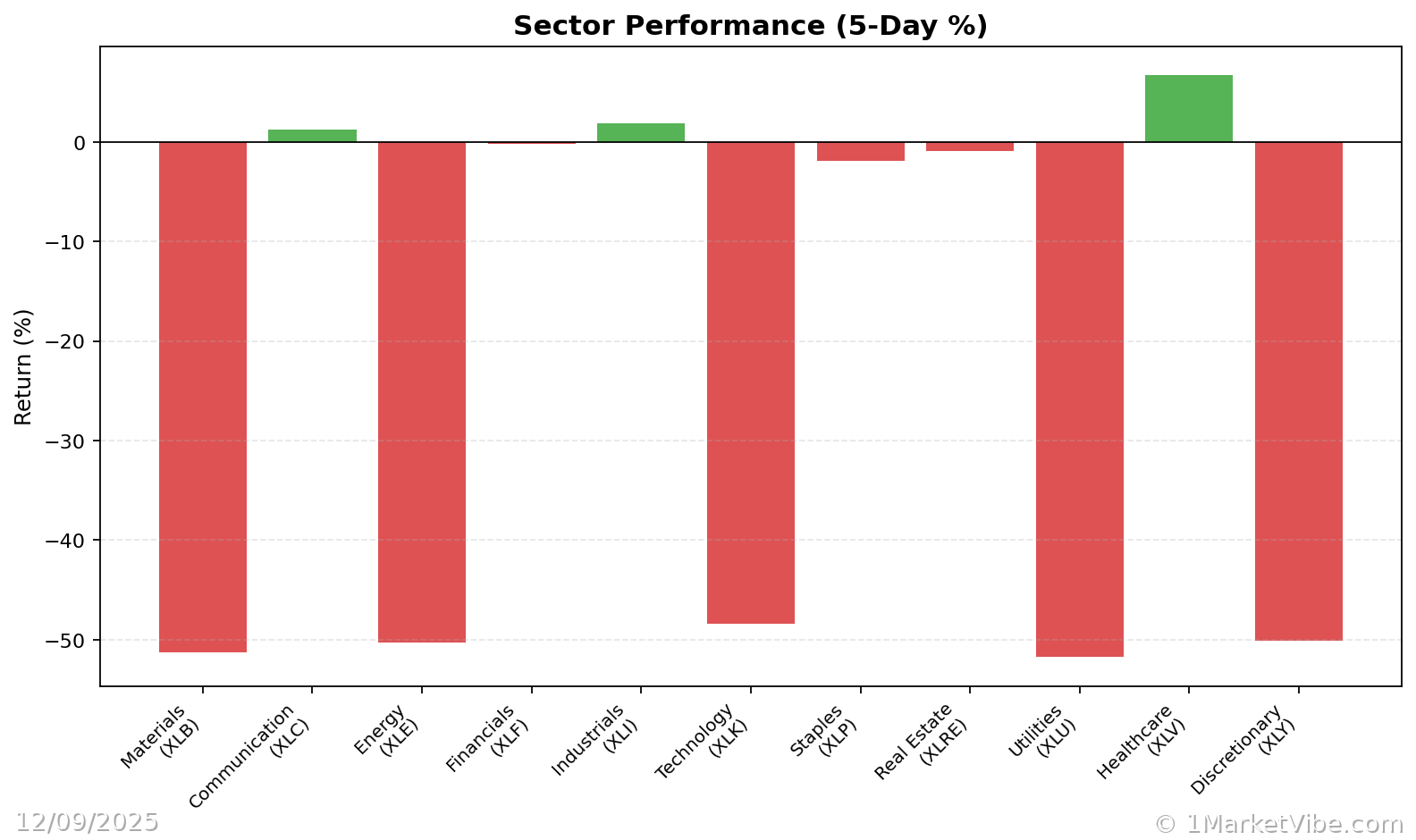

The uncertainties surrounding potential rate cuts have significant implications for investment strategies. Sectors such as technology and consumer goods may experience heightened volatility, while defensive sectors like utilities could offer stability. MarketVibe's proprietary system provides investors with the tools to assess these risks and opportunities, leveraging the CW Index's early warning capabilities to make informed decisions.

Market Reactions

Recent market trends illustrate the correlation between Fed signals and market performance. Historically, when the CW Index reached 7.1 in March 2023, markets fell 8.3% over the following month. This underscores the importance of the CW Index as a predictive tool. Current readings suggest that while risk is moderate, vigilance is necessary as the Fed's decisions unfold.

Risks and Cautions

Investors should be aware of the risks associated with rate cut expectations. MarketVibe's Enhanced CW Index provides a critical early warning system, but it is essential to approach investments with caution. The potential for increased volatility necessitates a balanced approach, with considerations for hedging and diversification to mitigate potential losses.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.57, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: Fed rate cut announcements

📚 Learn (2-Minute Deep Dive)

The current economic scenario is shaped by global trade tensions and domestic policy uncertainties. Historical parallels, such as the market downturn following the March 2023 CW Index spike, highlight the potential for significant market shifts. Monitoring the Fed's communications and economic indicators will be crucial in the coming weeks. The CW Index's gold component offers a 4-6 week advance notice, providing investors with a strategic edge in anticipating market corrections.

⚡ Act (Specific Steps)

- Reassess Portfolio Allocations: Consider reducing exposure to high-volatility sectors and increasing allocations in defensive stocks.

- Implement Risk Management Strategies: Use stop-loss orders to protect against potential downturns.

- Monitor CW Index Movements: If the CW Index approaches 6.5, consider further adjustments to mitigate risk.

- Stay Informed: Regularly check MarketVibe's updates for real-time insights.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In summary, the uncertainties surrounding the Fed's rate cut decisions present both challenges and opportunities for investors. MarketVibe's Enhanced CW Index at 5.57 serves as a vital tool in navigating these complexities, offering early warnings and strategic insights. By leveraging MarketVibe's proprietary systems, investors can make informed decisions and adapt to the evolving market landscape. Built by investors, for investors, MarketVibe provides the tools needed to stay ahead in uncertain times.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts