Fed's Rate Cut Signals Shift in Market Stability

The Federal Reserve's recent decision to cut interest rates by 0.25% has sparked significant discussions about the future of market stability. As investors digest this move, MarketVibe's proprietary Enhanced CW Index offers crucial insights into potential market corrections. This index, operating on a 0-10 scale, provides a 4-6 week early warning by tracking institutional gold flows and market breadth. Currently, the CW Index stands at 5.7, below the critical 7.0 threshold, indicating a moderate risk level. This reading suggests that while caution is warranted, immediate panic may be premature.

Learn more about how CW Index works at 1marketvibe.com.

Current Economic Landscape

The economic environment has been marked by a combination of factors, including persistent inflation, uneven effects of tariffs, and now, the Fed's rate cut. These elements contribute to a complex backdrop for investors. According to MarketVibe data, the CW Index's current level reflects these mixed signals, where the gold component's early warning system is particularly valuable. Historically, when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline over the following month, underscoring the importance of monitoring this index closely.

Fed's Decision-Making Process

The Federal Reserve's decision to lower rates is part of a broader strategy to stimulate economic growth amid global uncertainties. This move aims to counteract the effects of tariffs and inflation, which have been weighing on consumer confidence and spending. MarketVibe's CW Index suggests that while the rate cut may provide short-term relief, the potential for volatility remains if the index approaches the 6.5 level.

Market Stability Concerns

Despite the Fed's intervention, concerns about market stability persist. The CW Index at 5.7 indicates moderate risk, but investors should remain vigilant. The gold component of MarketVibe's system offers a 4-6 week advance notice, allowing investors to prepare for potential shifts. Should the index rise above 6.5, it would signal increased caution, reminiscent of past periods where similar conditions led to market downturns.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This framework transforms market intelligence into actionable decisions, empowering investors to navigate the current landscape effectively.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate risk.

- Market Status: Yellow flag—caution advised.

- Key Metric: Watch for CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The Fed's rate cut is a strategic attempt to bolster economic activity amid global challenges. Historically, similar monetary policies have provided temporary market boosts but have also led to increased volatility. The CW Index's current reading suggests that while immediate risks are moderate, the potential for future instability remains. Investors should pay close attention to the index's movement, particularly if it approaches the 6.5 threshold, which could indicate heightened market vulnerability.

⚡ Act (Specific Steps)

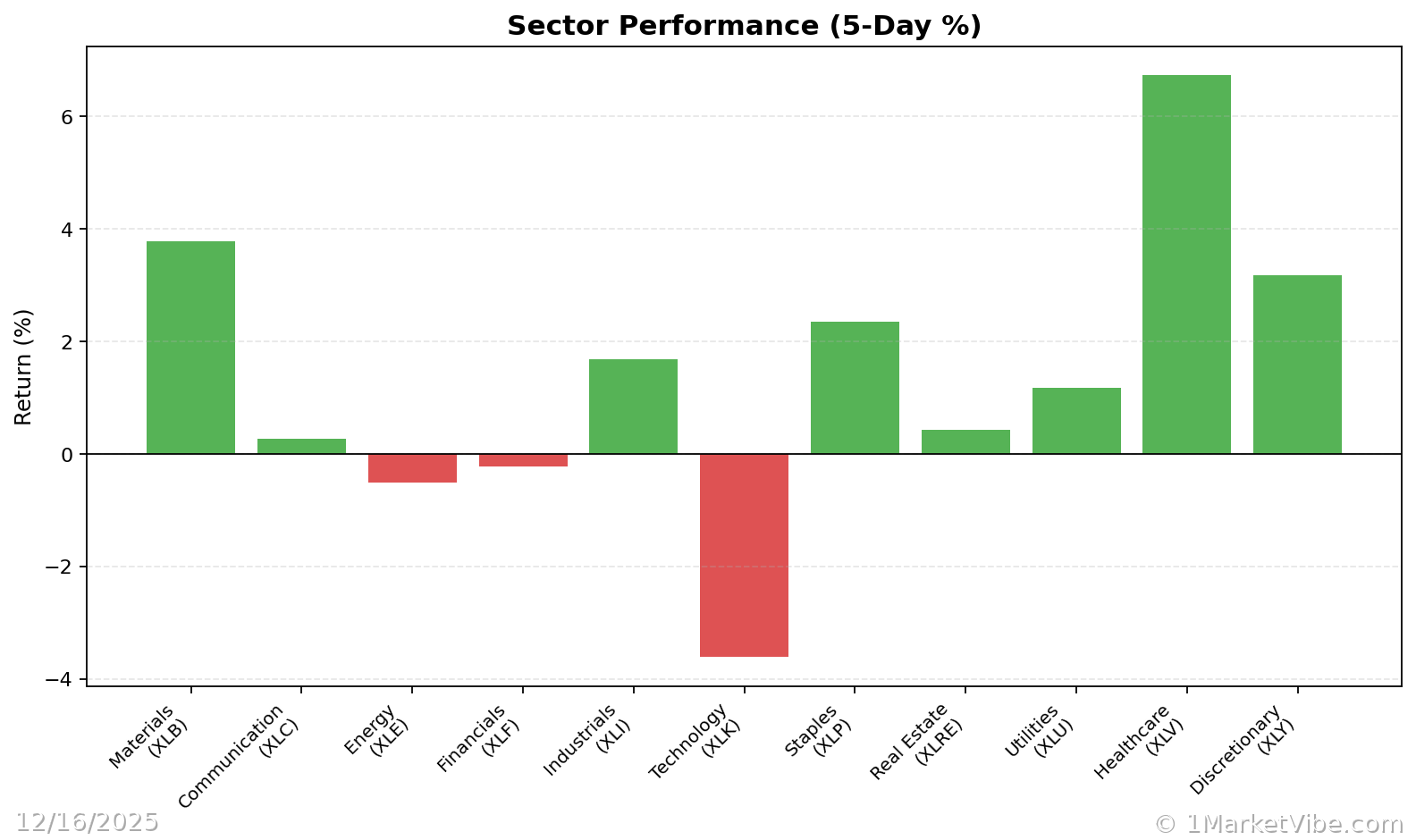

- Diversify Portfolios: Consider reallocating assets to include more stable sectors, such as utilities and consumer staples, which tend to perform well in uncertain times.

- Monitor CW Index: Regularly check the CW Index at 1marketvibe.com for real-time updates and alerts.

- Adjust Risk Exposure: If the CW Index trends towards 6.5, reduce exposure to high-volatility stocks and consider hedging strategies.

- Stay Informed: Utilize MarketVibe's tools to stay ahead of market shifts and make informed decisions.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Fed's rate cut is a pivotal moment for market stability, with the CW Index providing essential insights into potential risks. As the index remains at 5.7, investors should maintain a balanced approach, leveraging MarketVibe's tools to navigate these uncertain times. By staying informed and proactive, investors can better position themselves to respond to market changes effectively.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts