The Significance of IBM's $11 Billion Confluent Acquisition for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

The Significance of IBM's $11 Billion Confluent Acquisition for Investors

In the rapidly evolving landscape of technology, acquisitions often signal strategic shifts and can have profound impacts on market dynamics. IBM's potential acquisition of Confluent for approximately $11 billion is one such development that investors should closely monitor. This article will explore the significance of this acquisition, its implications for IBM and the broader tech sector, and how investors can integrate this information into their decision-making processes using MarketVibe's metrics.

Details of the Deal

IBM is reportedly in advanced negotiations to acquire Confluent, a leading data infrastructure company. The estimated value of this acquisition is around $11 billion, highlighting IBM's commitment to strengthening its data capabilities. This move is part of IBM's broader strategy to enhance its offerings in cloud computing and data management, areas where Confluent's technology could provide significant leverage.

IBM's Strategic Goals

IBM's acquisition of Confluent is aligned with its strategic goals of expanding its data infrastructure capabilities. Confluent specializes in real-time data streaming technology, which is increasingly critical in today's data-driven world. By integrating Confluent's technology, IBM aims to enhance its ability to process and analyze large volumes of data in real-time, thereby improving its cloud services and analytics offerings.

Confluent's Market Position

Confluent is a key player in the data infrastructure sector, known for its robust platform that enables organizations to harness the power of real-time data. This acquisition would not only bolster IBM's technological capabilities but also expand its customer base and market reach. Confluent's technology is expected to complement IBM's existing solutions, providing a competitive edge in the fast-growing cloud computing market.

Market Reactions

Initial market sentiment regarding the acquisition has been cautiously optimistic. Investors are keenly observing how this deal will impact IBM's stock and its position in the tech sector. The acquisition could potentially boost investor confidence in IBM's growth prospects, particularly if the integration of Confluent's technology leads to enhanced product offerings and increased market share.

Risks and Considerations

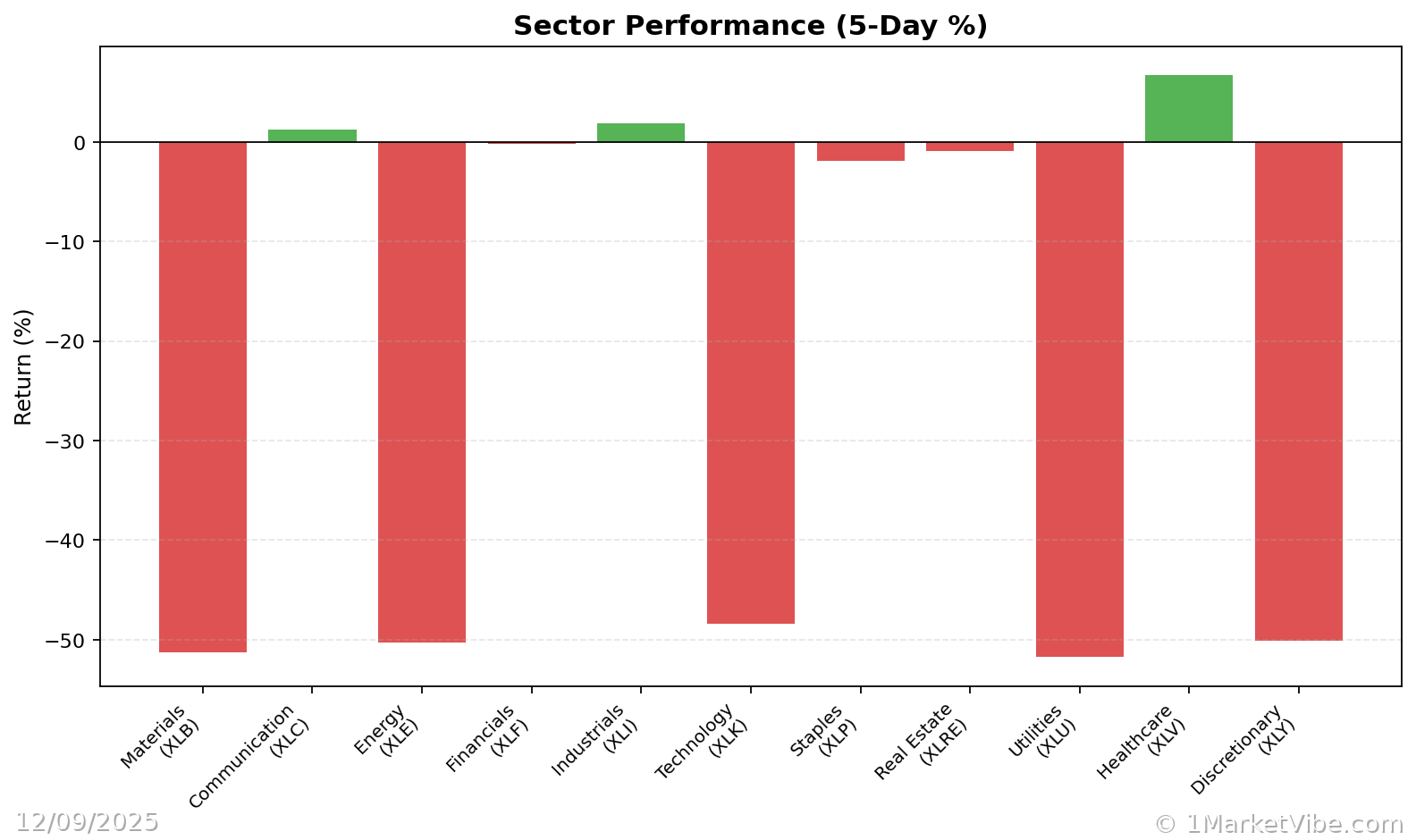

While the acquisition presents significant opportunities, it also comes with potential risks. Market volatility and integration challenges are common concerns in large-scale acquisitions. Investors should be mindful of these risks and consider how they might affect IBM's financial performance and stock valuation. Additionally, the broader market environment, as indicated by MarketVibe's metrics, should be factored into investment decisions.

Comparative Analysis

This acquisition can be compared to other recent tech deals, such as Nvidia's acquisition of Arm or Microsoft's purchase of Nuance Communications. These deals highlight the growing trend of tech giants acquiring specialized companies to enhance their technological capabilities and market positions. Lessons from these acquisitions suggest that successful integration and strategic alignment are critical to realizing the full potential of such deals.

Conclusion

IBM's potential acquisition of Confluent is a significant development in the tech industry, with implications for both companies and the broader market. Investors should monitor this deal closely, considering its potential impact on IBM's strategic direction and market performance.

How to Use This Insight in a Process

Investors can use MarketVibe's Decision Edge Dashboard to monitor the broader market environment and adjust their strategies accordingly. For instance, if the Crash Warning Index (CWI) is elevated, indicating heightened market risk, investors might consider reducing exposure to tech stocks or employing hedging strategies. Conversely, if breadth indicators like the % Above 50-DMA show strong market health, it could be a signal to increase exposure to growth sectors, including tech.

Common Misuses & Misconceptions

Treating Acquisition News as a Stand-Alone Signal: Investors should avoid making decisions based solely on acquisition news. It's essential to consider the broader market context and other relevant metrics.

Ignoring Integration Challenges: Acquisitions often face integration hurdles that can affect the acquiring company's performance. Investors should factor in these potential challenges when assessing the impact of the deal.

Overreacting to Short-Term Market Movements: Market reactions to acquisition news can be volatile. Investors should maintain a long-term perspective and avoid making impulsive decisions based on short-term price fluctuations.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

This analysis is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. MarketVibe content reflects observable market data and historical context as of the publication date and should not be relied upon as a sole basis for investment decisions. Market conditions can change rapidly and unpredictably.

Charts