Implications of Postponed Senate Session on the Digital Asset Market

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Implications of Postponed Senate Session on the Digital Asset Market

In the ever-evolving landscape of financial markets, legislative actions can have significant impacts on market sentiment and behavior. Recently, the Senate Committee on Banking, Housing, and Urban Affairs postponed an Executive Session intended to consider the Digital Asset Market Clarity Act of 2025. This article explores the potential implications of this postponement on the digital asset market, using MarketVibe's analytical frameworks to provide a structured understanding of the situation.

Understanding the Legislative Context

The Senate Committee on Banking, Housing, and Urban Affairs plays a crucial role in shaping financial legislation in the United States. The Executive Session was set to discuss H.R.3633, the Digital Asset Market Clarity Act of 2025, which aims to provide clearer regulatory guidelines for digital assets. The postponement of this session introduces uncertainty into the market, as stakeholders are left waiting for clarity on regulatory directions.

Why Traders Should Care

Traders should pay attention to this development because legislative clarity can significantly influence market dynamics, especially in the digital asset sector. The postponement may lead to increased volatility and uncertainty, affecting decision-making processes for traders. Understanding how this fits into a structured trading process can help mitigate risks and capitalize on opportunities.

How MarketVibe Metrics Can Help

MarketVibe offers several metrics that can help traders navigate the uncertainty brought about by legislative delays:

- Crash Warning Index (CWI): This composite index measures risk by analyzing breadth, volatility, and defensive behavior. A rising CWI could indicate heightened risk, suggesting traders should be cautious.

- % Above 50-DMA: This breadth indicator shows the percentage of stocks trading above their 50-day moving average. A decline in this metric might signal weakening market health.

- ATR% (Average True Range Percentage): This volatility measure helps traders understand market stability. An increase in ATR% suggests rising volatility, which could be exacerbated by legislative uncertainty.

Interpreting the Metrics

Crash Warning Index (CWI)

- Below 3: Generally indicates a stable market environment.

- Above 6: Suggests elevated risk, where corrections are more likely.

% Above 50-DMA

- Above 70%: Indicates strong market breadth and potential bullish conditions.

- Below 30%: Suggests weak market breadth, often seen in bearish or oversold conditions.

ATR%

- Low ATR%: Corresponds to quiet, trending phases.

- High ATR%: Indicates choppy or unstable market conditions.

Real-World Scenarios

Scenario: Rising CWI and High ATR%

- Metrics: CWI above 6, ATR% increasing.

- Market Behavior: Increased volatility and risk perception.

- Trader Response: Consider reducing exposure and employing defensive strategies.

Scenario: Strong Breadth with Low Volatility

- Metrics: % Above 50-DMA above 70%, low ATR%.

- Market Behavior: Stable, trending market conditions.

- Trader Response: More open to adding exposure, focusing on strong setups.

Scenario: Legislative Uncertainty with Weak Breadth

- Metrics: % Above 50-DMA below 30%, high ATR%.

- Market Behavior: Uncertainty and potential for downside.

- Trader Response: Emphasize risk management and avoid aggressive positions.

Incorporating Insights into a Trading Process

To effectively use these insights, traders should integrate MarketVibe metrics into their broader decision-making framework:

- Risk Management: When CWI is high and breadth is weak, prioritize defensive strategies and reduce new risk exposure.

- Opportunity Identification: In environments with strong breadth and low volatility, be prepared to capitalize on bullish setups.

- Monitoring Tools: Use the Market Dashboard to assess overall market climate and confirm internal signals before making decisions.

Common Misuses and Misconceptions

- Over-Reliance on a Single Metric: Avoid using any single metric as a stand-alone entry signal. Instead, consider a combination of metrics for a holistic view.

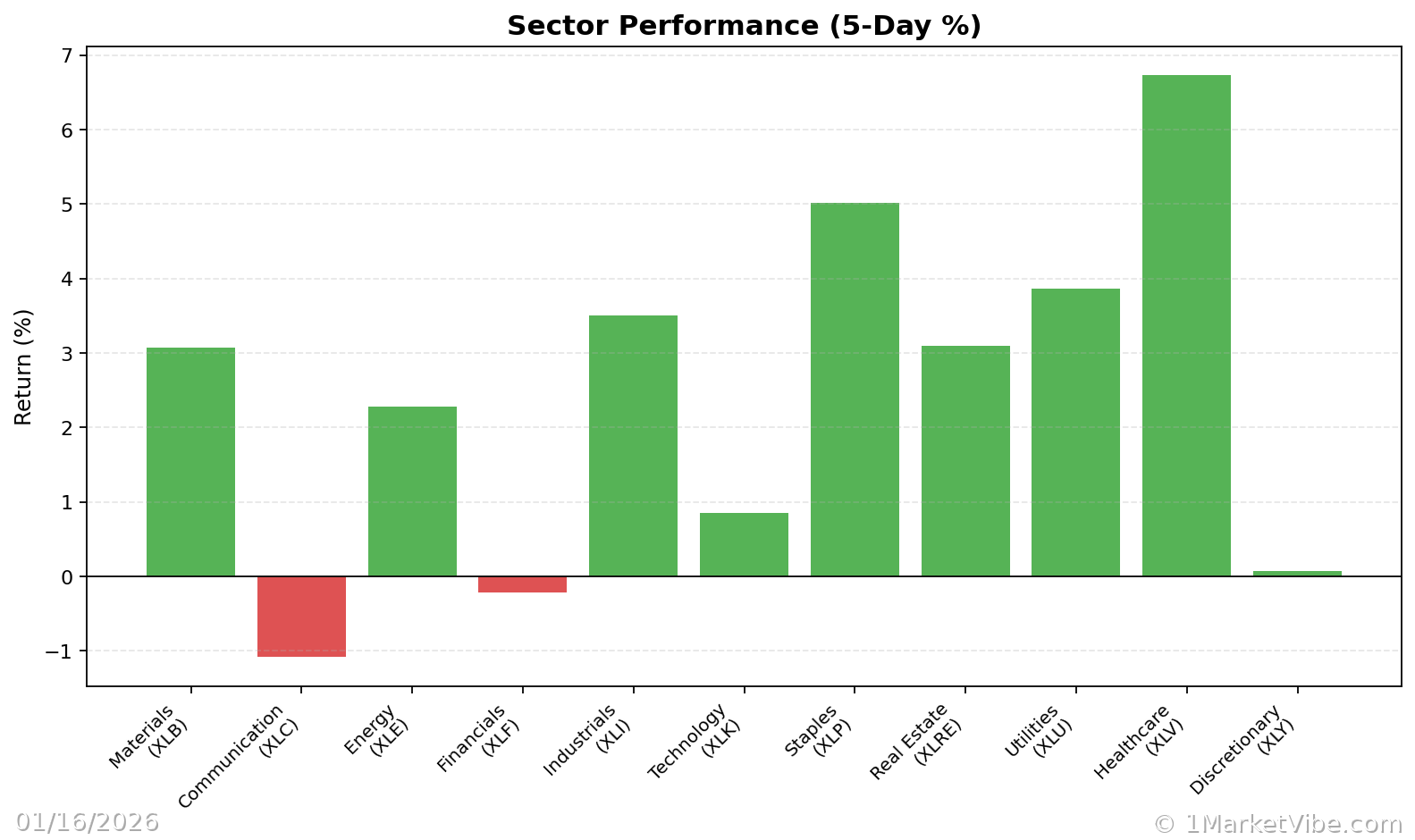

- Ignoring Context: Always consider sector rotation and broader market trends when interpreting metrics.

- Overreacting to Daily Changes: Focus on trends and sustained movements rather than reacting to one-day fluctuations.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

This content is for informational purposes only and should not be considered as investment advice. Market conditions can change rapidly and unpredictably. MarketVibe authors, editors, and affiliates may hold positions in securities discussed in our analysis. However, our editorial policy prohibits trading on non-public information and requires disclosure of material conflicts.