CME Halt Raises Liquidity Concerns for Investors

Introduction

The recent halt in trading at the Chicago Mercantile Exchange (CME) has raised significant concerns about liquidity and market stability among investors. This event is not just an isolated incident but a reflection of broader systemic issues that can affect market operations. Understanding the implications of such halts is crucial for traders who need to navigate the complexities of market dynamics effectively.

Impact on Liquidity

Trading halts, like the one experienced at the CME, can significantly disrupt liquidity in financial markets. Liquidity refers to the ease with which assets can be bought or sold in the market without affecting their price. When a major exchange halts trading, it can lead to a sudden lack of liquidity, making it difficult for investors to execute trades at desired prices.

Historically, trading halts have led to increased volatility as traders rush to adjust their positions once trading resumes. For example, during the 2010 Flash Crash, a temporary halt in trading exacerbated market instability, leading to a rapid decline and recovery in asset prices. Such events highlight the importance of liquidity as a stabilizing force in financial markets.

Market Stability Concerns

The potential ripple effects of a trading halt extend beyond immediate liquidity issues. They can also undermine overall market stability. When investors perceive a lack of stability, it can lead to a loss of confidence, prompting further volatility. This is particularly concerning in an environment where market sentiment is already fragile.

Investor sentiment plays a crucial role in market reactions. When sentiment is negative, as indicated by a high Crash Warning Index (CWI) reading, markets are more susceptible to sharp corrections. The current CWI reading of 6.5 suggests elevated risk levels, indicating that the market is on edge and could react strongly to further disruptions.

Cybersecurity Context

The CME halt also underscores the growing importance of cybersecurity in market operations. Recent cyber-attacks, such as the ransomware attack on Asahi, have demonstrated how vulnerable market infrastructure can be to digital threats. These attacks can disrupt operations, leading to trading halts and increased market uncertainty.

Cybersecurity issues are not just technical problems; they have real financial implications. As markets become more interconnected and reliant on digital infrastructure, the risk of cyber-attacks affecting market stability increases. Traders need to be aware of these risks and incorporate them into their risk management strategies.

Current Market Sentiment

The current market sentiment, as reflected by the CWI, suggests that traders should be cautious. A CWI reading above 6 indicates heightened risk, which often precedes market corrections. In such an environment, traders should focus on preserving capital and managing risk rather than aggressively seeking returns.

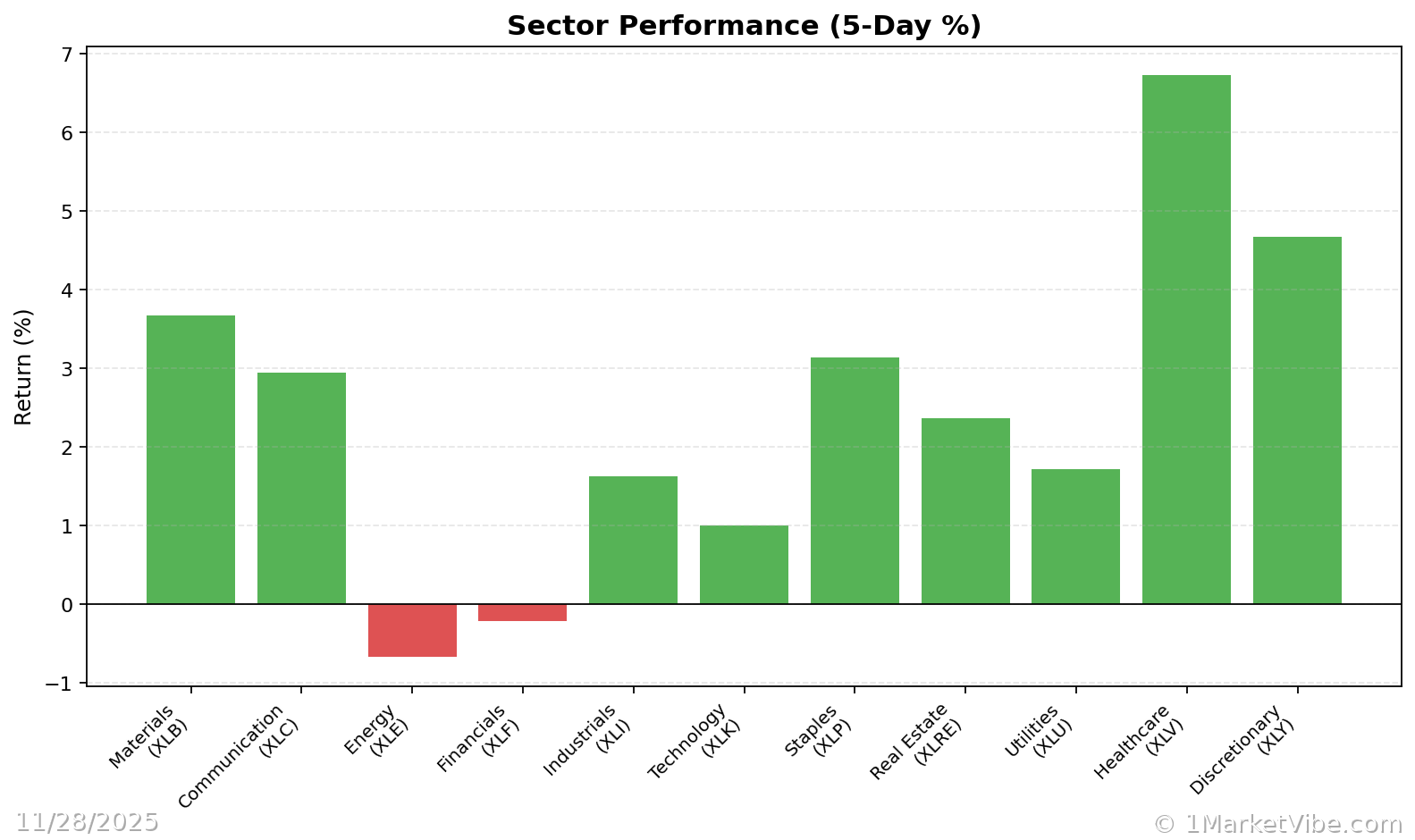

The Decision Edge Dashboard can provide valuable insights into market conditions. By monitoring metrics such as % Above 50-DMA and ATR%, traders can gain a better understanding of market trends and volatility. For instance, a low % Above 50-DMA combined with high ATR% could indicate a volatile and potentially bearish market environment.

Comparative Analysis

Comparing the CME halt with other recent trading disruptions can provide valuable lessons. For example, the 2020 COVID-19 pandemic led to multiple trading halts as markets reacted to unprecedented uncertainty. In each case, the key takeaway is the importance of maintaining a flexible and adaptive trading strategy.

Patterns observed in past incidents suggest that markets often overreact to initial disruptions but stabilize over time as more information becomes available. Traders who can remain calm and avoid knee-jerk reactions are often better positioned to capitalize on opportunities once stability returns.

Investor Strategies

In light of the current uncertainty, investors should consider several strategies to navigate the market effectively:

Risk Management: Emphasize risk management by adjusting position sizes and using stop-loss orders to protect against adverse price movements.

Diversification: Diversify portfolios to reduce exposure to any single asset or sector, thereby mitigating the impact of market disruptions.

Hedging: Consider hedging strategies, such as options or futures, to protect against downside risk, especially if the CWI continues to indicate elevated risk levels.

Monitoring: Use tools like the Decision Edge Dashboard to monitor market conditions and adjust strategies accordingly.

Conclusion

The CME trading halt serves as a reminder of the complex interplay between liquidity, market stability, and cybersecurity. By understanding these dynamics and incorporating them into a structured trading process, investors can better navigate periods of uncertainty. Monitoring key metrics and maintaining a disciplined approach to risk management are essential for long-term success in volatile markets.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

This analysis is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. MarketVibe content reflects observable market data and historical context as of the publication date and should not be construed as personalized advice. Market conditions can change rapidly and unpredictably.