Ex-Fed Governor's Ethics Probe Signals Market Instability Ahead

Breaking News: What Happened

In a surprising turn of events, former Federal Reserve Governor Adriana Kugler has come under scrutiny following an ethics probe that led to her abrupt resignation. This development, reported by Bloomberg on October 15, 2023, has raised eyebrows across financial markets, as Kugler's departure allowed for a strategic appointment by President Donald Trump. The probe revealed potential violations of ethical standards during her tenure, sparking concerns about the integrity of decision-making processes within the Federal Reserve.

Why It Matters

For investors, this situation introduces a layer of uncertainty regarding the Federal Reserve's future policy directions. The immediate market impact is evident as investors grapple with the potential implications of leadership changes at the central bank. Historically, such transitions can lead to shifts in monetary policy, affecting interest rates and market stability. The broader implications suggest that investors should brace for potential volatility, as the Federal Reserve's credibility and decision-making processes are called into question.

Context & Background

Adriana Kugler's resignation is not an isolated incident but rather part of a broader narrative of ethical challenges faced by high-ranking officials. Her departure follows a series of ethical breaches within the financial sector, highlighting a recurring theme of governance issues. The Federal Reserve, a cornerstone of U.S. economic stability, now faces increased scrutiny over its internal controls and ethical standards. This probe could potentially undermine investor confidence, reminiscent of past instances where leadership changes have led to market turbulence.

Market Reactions

- Stock Market Volatility: Following the announcement, major indices experienced fluctuations, with the S&P 500 dipping by 0.5% as investors reassessed their positions.

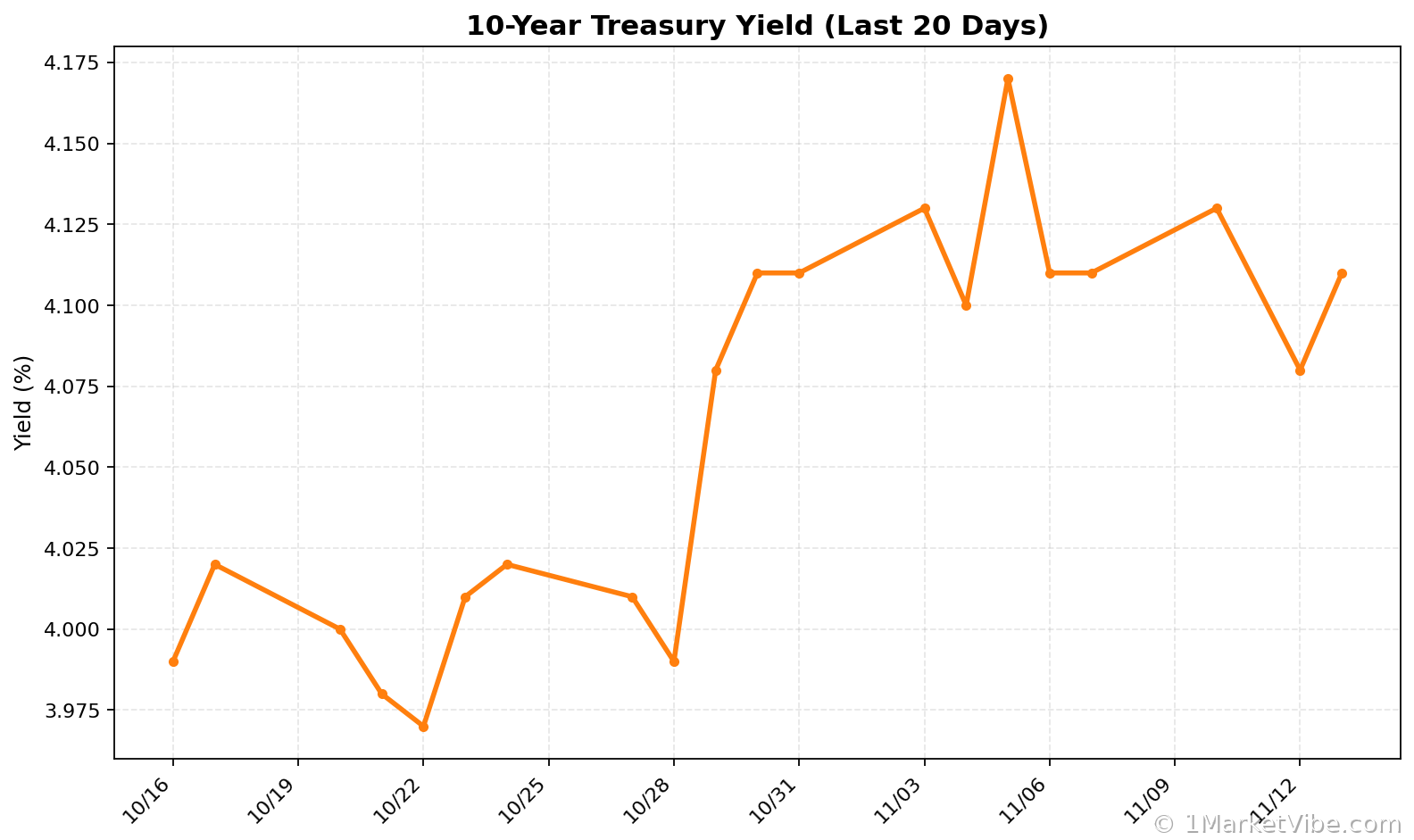

- Bond Yields: U.S. Treasury yields saw a slight increase, reflecting investor caution and a potential shift in monetary policy expectations.

- Currency Markets: The U.S. dollar exhibited mixed reactions, initially weakening against major currencies before stabilizing.

Potential Implications for Monetary Policy

The ethics probe and subsequent resignation could influence the Federal Reserve's policy trajectory. With a new appointee potentially altering the balance of the Federal Open Market Committee (FOMC), investors should watch for changes in interest rate policies. This development may also affect the Fed's approach to inflation and economic growth, key factors that drive market sentiment.

Investor Sentiment

Investor sentiment has turned cautious, with a heightened focus on risk management. The uncertainty surrounding the Federal Reserve's leadership could lead to increased market volatility. For investors, this means a need to reassess portfolio allocations, particularly in sectors sensitive to interest rate changes. Monitoring the Federal Reserve's communications will be crucial in navigating this uncertain landscape.

What's Next

- Upcoming FOMC Meetings: Investors should keep an eye on the next FOMC meetings for any policy shifts or announcements regarding new appointments.

- Ethics Probe Developments: Further details from the ethics probe could emerge, potentially impacting market sentiment and the Federal Reserve's credibility.

- MarketVibe's CW Index: While specific data is unavailable, investors are advised to monitor MarketVibe's CW Index for early risk signals as the situation develops.

Conclusion

The ethics probe into former Fed Governor Adriana Kugler underscores potential instability within the Federal Reserve, with significant implications for monetary policy and market stability. Investors should remain vigilant, adjusting their strategies to account for potential volatility and shifts in economic policy.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.