Zohran Mamdani's Starbucks Boycott: Impact on NYC's Market Dynamics

Overview of the Boycott

Zohran Mamdani, a prominent New York City politician, has called for a boycott of Starbucks amidst ongoing labor strikes. This move is not just a statement of solidarity with striking workers but also a strategic maneuver in the broader political landscape of NYC. As Starbucks faces labor unrest, Mamdani's call to action could influence both consumer behavior and corporate policies.

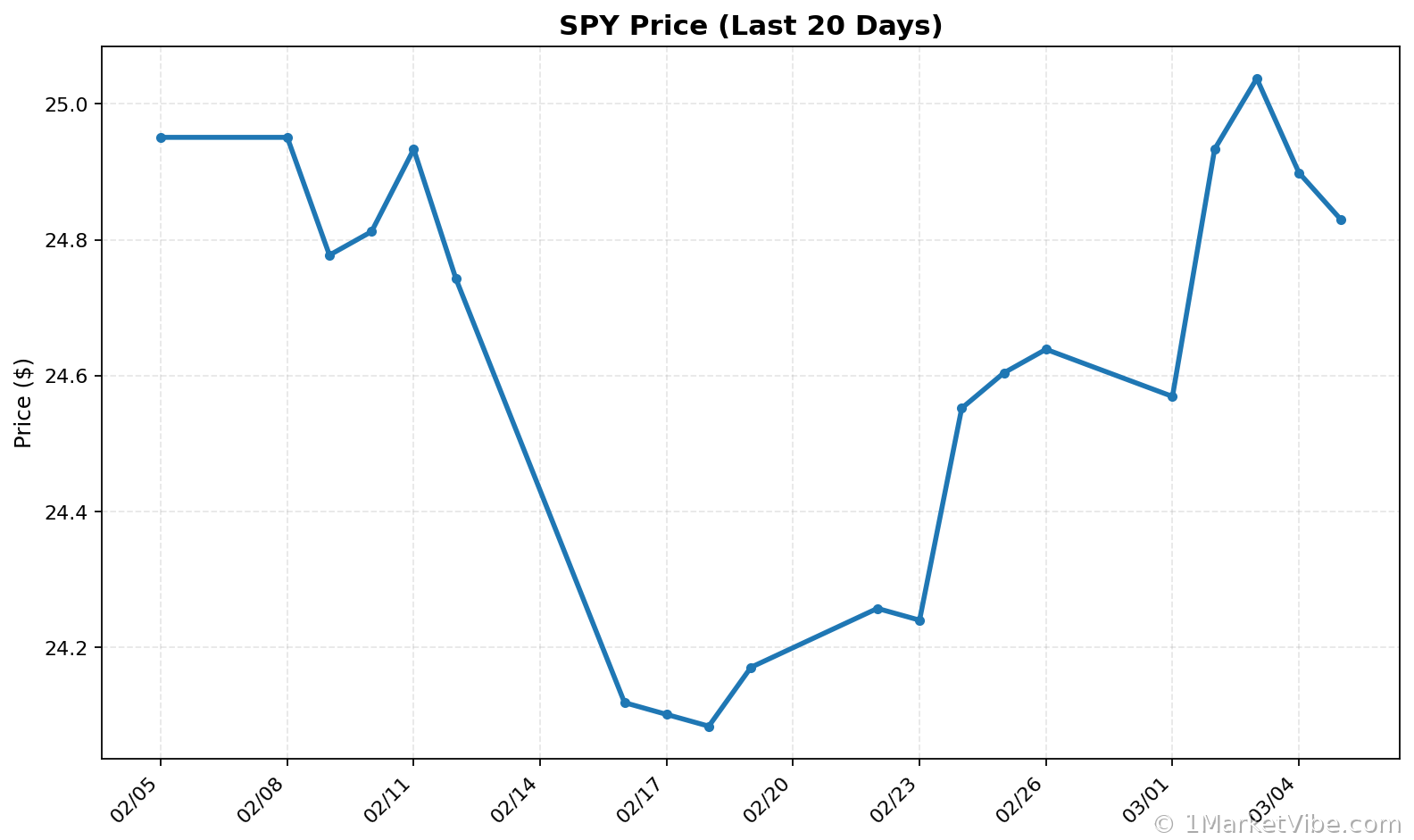

MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This reading is below the 7.0 warning threshold, indicating moderate risk. While this specific boycott is independent of current CW Index signals, it adds another layer of complexity to the market dynamics investors must navigate. Learn more about how CW Index works at 1marketvibe.com

Zohran Mamdani's Political Influence

Zohran Mamdani is known for his progressive stance on labor rights and has a history of advocating for workers' issues. As a public figure in NYC politics, his actions carry significant weight. His previous statements and actions have often aligned with labor movements, making this boycott a continuation of his advocacy for fair labor practices. Mamdani's influence in NYC politics could potentially sway public opinion and consumer behavior, affecting Starbucks' market performance.

Labor Strikes and Starbucks

The current labor strikes affecting Starbucks are part of a broader trend of labor unrest within the company. Historically, Starbucks has faced challenges with labor relations, which have impacted its corporate policies. The ongoing strikes and Mamdani's boycott call could further strain these relations, potentially affecting Starbucks' operational efficiency and market perception.

Market Impact and Consumer Behavior

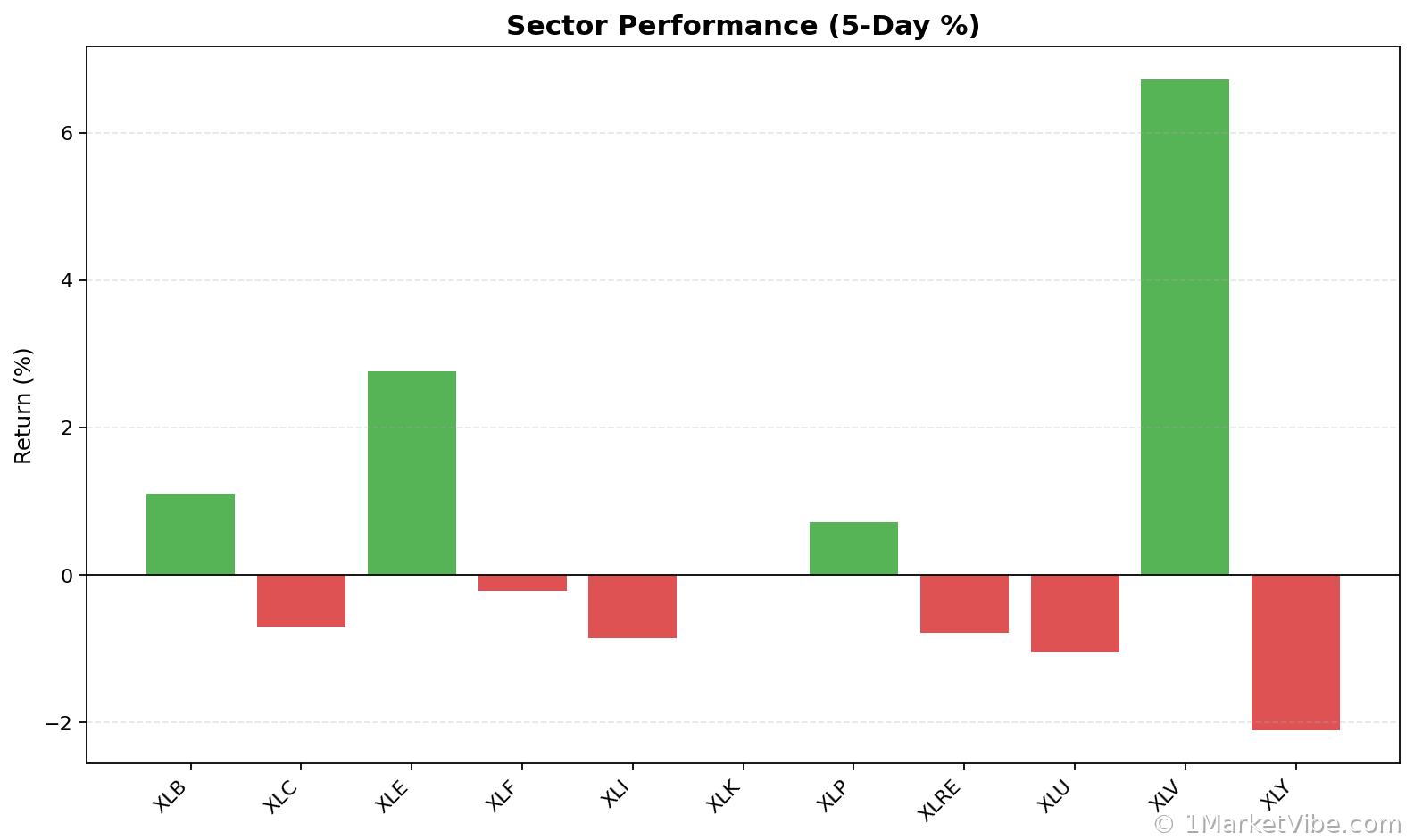

The potential effects on Starbucks' market performance are multifaceted. Public response to Mamdani's boycott call could lead to shifts in consumer behavior, impacting Starbucks' sales and brand image. Additionally, the political ramifications for Mamdani's career and NYC governance are significant, as his actions may influence future labor policies and corporate practices.

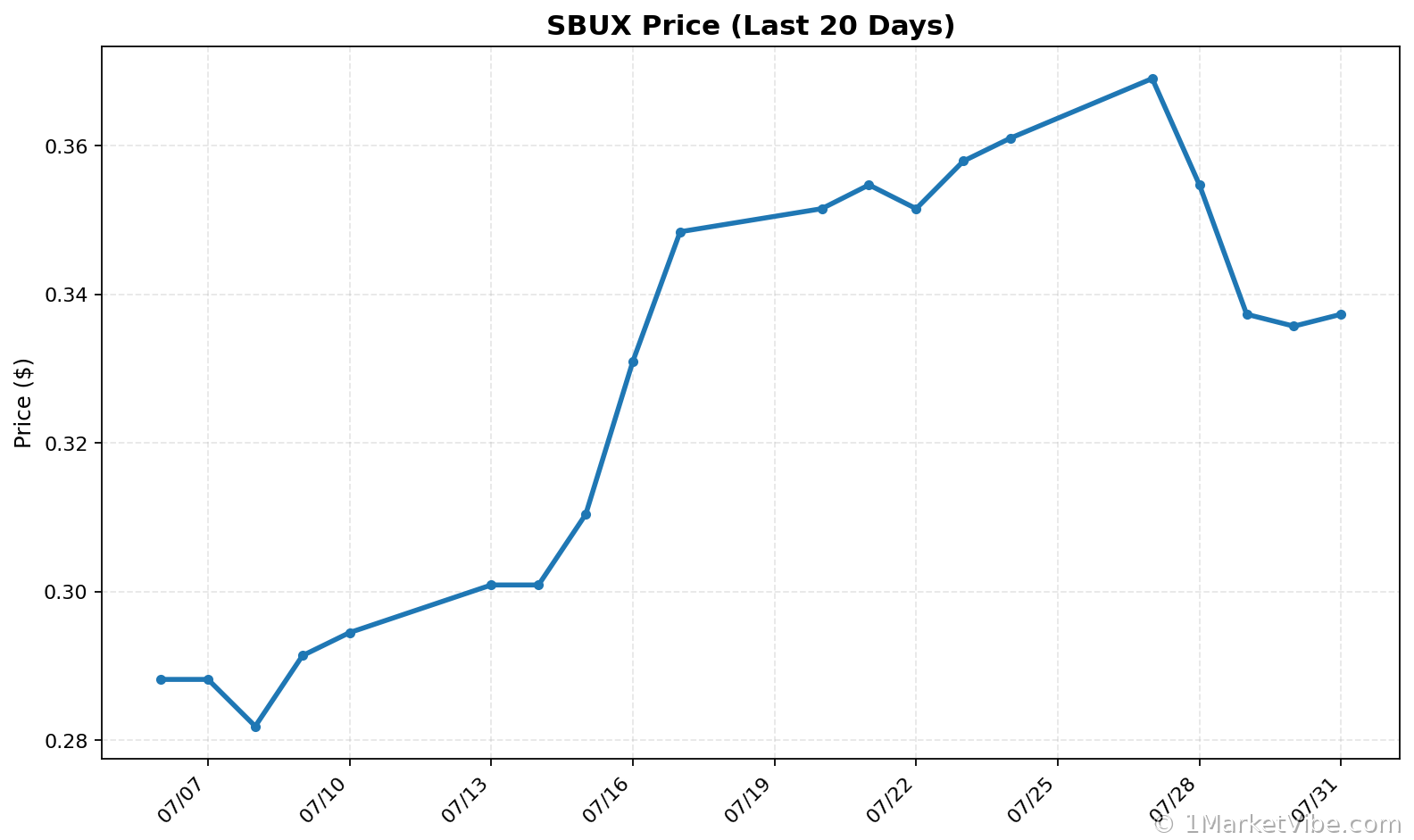

Stock Market Response

The stock market's response to labor strikes and boycotts can vary. Historical data shows that similar boycotts have led to short-term volatility in stock prices. For instance, when MarketVibe's CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. Investors are increasingly sensitive to corporate labor practices, and any escalation in the current situation could trigger market reactions. MarketVibe's CW Index suggests monitoring these developments closely.

Public Opinion and Social Media

Public opinion on Starbucks and labor issues is divided. Social media reactions to Mamdani's call for a boycott highlight the polarized views on corporate labor practices. Comparing this situation with other recent boycotts, it is clear that consumer sentiment can significantly impact a company's market position. MarketVibe tracks these trends to provide investors with actionable insights.

Long-term Effects on Starbucks

The long-term effects on Starbucks' brand image depend on the outcome of ongoing labor negotiations. Monitoring these developments is crucial for investors, as they could have implications for other companies facing similar labor issues. MarketVibe's 4-6 week early warning system, built by investors for investors, provides a strategic advantage in anticipating these shifts.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: Labor strike developments and consumer sentiment

📚 Learn (2-Minute Deep Dive)

The current labor strikes at Starbucks, coupled with Mamdani's boycott call, present a unique market development worth monitoring. Historical parallels, such as the 2023 market dip following labor unrest, highlight the potential for volatility. Investors should watch for changes in consumer behavior and corporate responses, as these could influence market dynamics. The situation underscores the importance of understanding labor relations and their impact on market performance.

⚡ Act (Specific Steps)

- Monitor position sizing: Adjust based on CW Index levels, particularly if it trends towards 6.5 or higher.

- Adjust risk exposure: Consider reducing exposure to sectors affected by labor unrest.

- Hedging strategies: Implement hedging strategies if the CW Index continues trending upwards.

- Entry/exit criteria: Set clear criteria based on market developments and CW Index signals.

Get real-time CW Index alerts at 1marketvibe.com →

Conclusion

Zohran Mamdani's call to boycott Starbucks amid ongoing labor strikes highlights the intricate interplay between politics, consumer behavior, and market dynamics. While the current CW Index reading of 5.7 suggests moderate risk, the situation warrants close observation. MarketVibe's tools, including the Enhanced CW Index and Decision Edge™ Method, provide investors with the insights needed to navigate these complexities effectively.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. MarketVibe content reflects observable market data and historical context as of the publication date and should not be relied upon as a sole basis for investment decisions.

Charts