Kevin Hassett's Influence as Fed Chair and Its Impact on Market Dynamics

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Kevin Hassett's Influence as Fed Chair and Its Impact on Market Dynamics

Orientation – What Are We Explaining?

In this article, we will explore the potential influence of Kevin Hassett as the Federal Reserve Chair and how his leadership could impact market dynamics. Understanding the implications of such a leadership change is crucial for traders and investors as it can significantly alter monetary policy, interest rates, and market stability. This insight helps traders make informed decisions about risk management, portfolio adjustments, and strategic planning. It is not about predicting exact market movements but about understanding the broader implications of leadership changes on the financial environment.

How It Works – Mechanics & Data

The Federal Reserve Chair plays a pivotal role in shaping U.S. monetary policy, which in turn influences interest rates, inflation, and economic growth. Kevin Hassett, known for his economic expertise and previous roles in government, brings a particular set of views and policies that could shift the current monetary landscape.

MarketVibe's Crash Warning Index (CWI) is particularly relevant here. The CWI is a composite indicator that assesses market risk by evaluating several dimensions, including breadth, volatility, and defensive behavior. Currently, the CWI stands at 6.9, indicating elevated risk levels. This suggests that traders should be cautious, as the market is in a potentially unstable phase.

The Market Dashboard provides a high-level view of market conditions, helping traders understand the current regime. It combines data from various MarketVibe metrics to offer a comprehensive picture of market health and risk.

Interpretation – What Different Levels Tend to Mean

Crash Warning Index (CWI):

- Below 3: Low risk, stable market conditions.

- 3 to 6: Moderate risk, potential for increased volatility.

- Above 6: High risk, corrections become more likely.

When the CWI is above 6, as it is now, it signals that traders should be more defensive, potentially reducing exposure to high-risk assets and considering hedging strategies.

Market Dashboard States:

- Bullish Climate: Strong breadth, low volatility, favorable for risk-taking.

- Neutral Climate: Mixed signals, requiring cautious optimism.

- Bearish Climate: Weak breadth, high volatility, favor defensive strategies.

Real-World Scenarios – How This Shows Up in Markets

Topping Environment:

- Scenario: Major indices grind higher, but underlying breadth deteriorates.

- Metrics: % Above 50-DMA declines, CWI rises above 6.

- Trader Temptation: Chase the rally.

- Informed Response: Recognize the risk of a pullback, reduce exposure.

Strong Bull Leg:

- Scenario: A new bull market begins, with strong participation across sectors.

- Metrics: % Above 50-DMA surges, CWI below 3.

- Trader Temptation: Hesitate due to past losses.

- Informed Response: Increase exposure, focus on leading sectors.

Volatility Spike:

- Scenario: Sudden market drop, increased fear.

- Metrics: ATR% spikes, CWI accelerates.

- Trader Temptation: Panic sell.

- Informed Response: Evaluate long-term positions, consider adding to quality names at lower prices.

How to Use This Insight in a Process

- When CWI is High: Prioritize capital preservation. Consider reducing position sizes and increasing cash reserves. Look for opportunities to hedge against downside risk.

- When Breadth and Leadership Broaden: Be open to increasing exposure, but ensure that setups align with your strategy. Use the Market Dashboard to confirm the broader market regime.

- Use Market Dashboard: As a high-level regime label, it helps you align your strategy with current market conditions. Always check internals for confirmation before making significant portfolio changes.

Common Misuses & Misconceptions

Treating Metrics as Stand-Alone Signals: Metrics like CWI should not be used in isolation. Always consider the broader market context and other indicators.

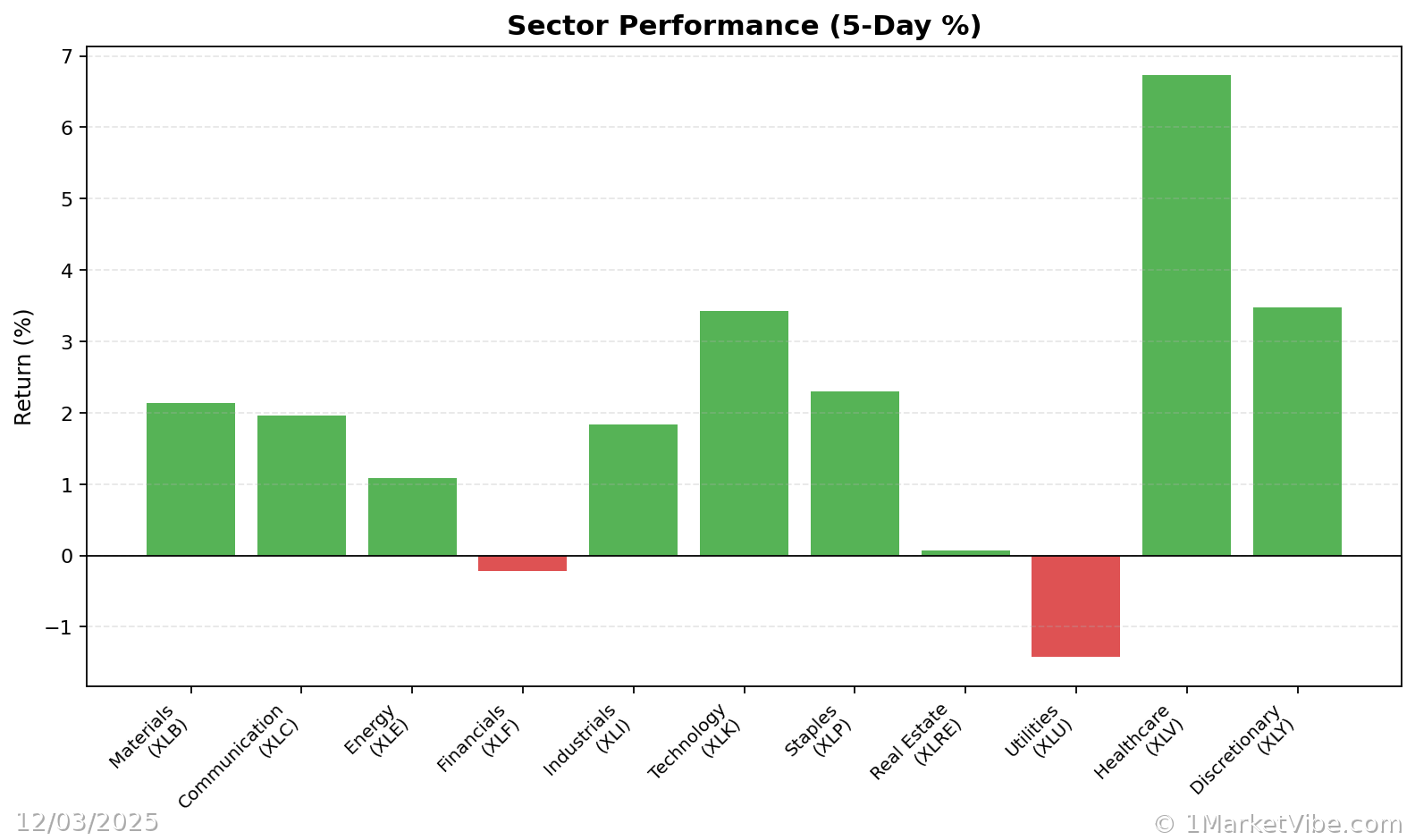

Ignoring Sector Rotation: Leadership can shift between sectors. Pay attention to sector scores to understand where strength is emerging.

- Overreacting to One-Day Changes: Markets are dynamic, and one-day movements can be misleading. Focus on trends and sustained changes in metrics.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult a financial advisor before making investment decisions.