Fed Rate Cut Expectations and the Dollar's Five-Week Low Indicate Market Risk

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Fed Rate Cut Expectations and the Dollar's Five-Week Low Indicate Market Risk

In recent weeks, market dynamics have been significantly influenced by expectations of a Federal Reserve rate cut and the U.S. dollar reaching a five-week low. These developments are crucial for traders to understand, as they provide insights into potential market risks and opportunities. In this article, we'll explore how these factors interact with MarketVibe's metrics, such as the Crash Warning Index (CWI), breadth indicators, and volatility measures, to help traders make informed decisions.

Orientation – What Are We Explaining?

The focus of this discussion is on the Crash Warning Index (CWI) and its role in assessing market risk. The CWI is a composite metric that evaluates several dimensions of market risk, including breadth, volatility, and defensive behavior. Traders should care about the CWI because it offers a structured way to gauge the underlying risk environment, helping them make better-informed decisions about risk management and exposure.

The CWI can inform decisions by highlighting when market conditions are deteriorating, even if surface-level indicators like major indices appear stable. It helps reduce blind spots by providing a comprehensive view of market internals, which is crucial for maintaining a disciplined trading process.

How It Works – Mechanics & Data

The CWI is constructed by aggregating data from several key market dimensions:

- Breadth: This includes metrics like the % Above 50-DMA, which measures the percentage of stocks trading above their 50-day moving average. A higher percentage indicates stronger market breadth.

- Volatility: Measured through indicators like ATR%, which assesses average true range as a percentage of price, providing insight into market volatility.

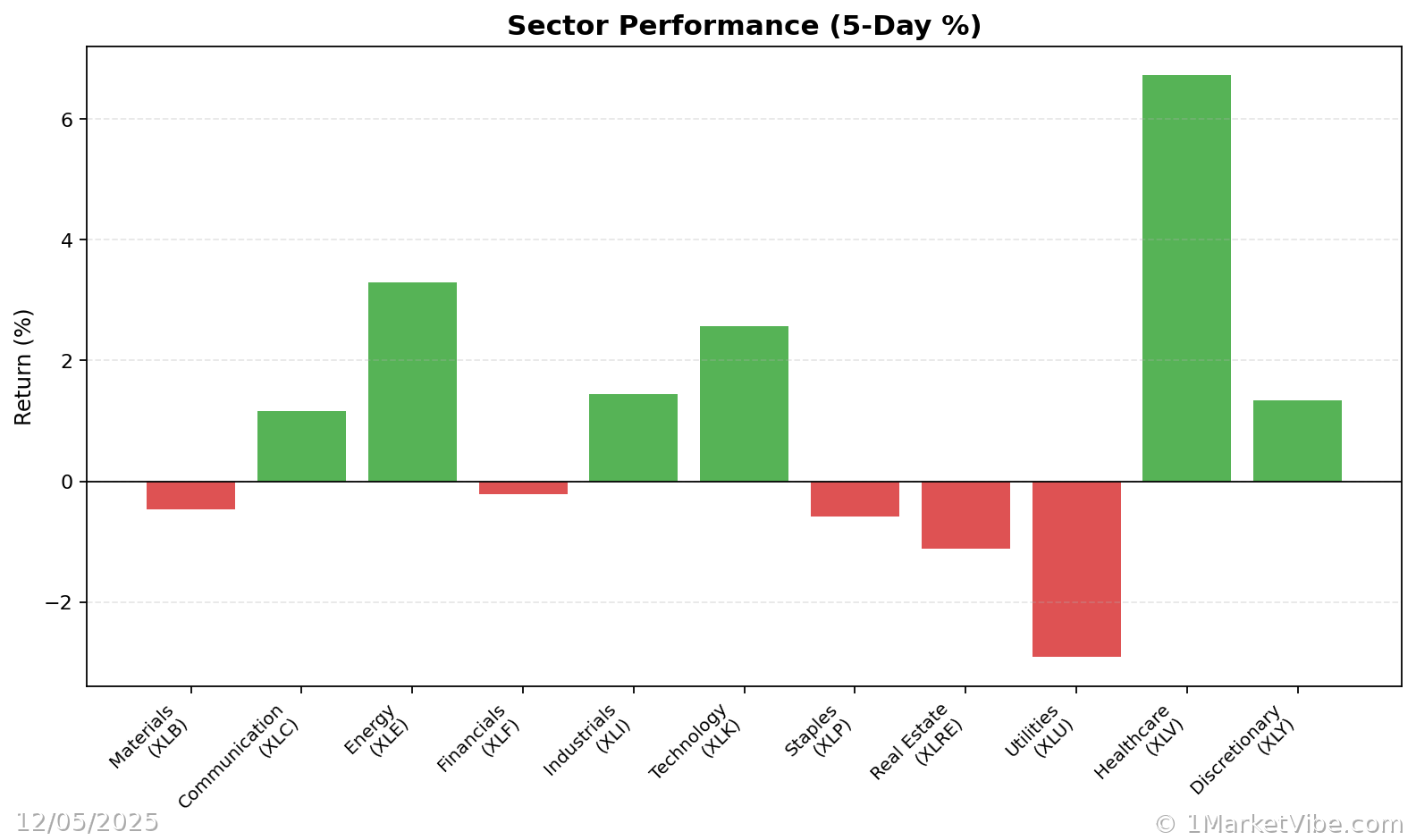

- Defensive Behavior: Observations of sector rotation and the performance of defensive sectors can indicate shifts in market sentiment.

The CWI moves based on changes in these underlying components. For example, a decline in the % Above 50-DMA or an increase in ATR% can signal rising market risk, pushing the CWI higher.

Interpretation – What Different Levels Tend to Mean

CWI Ranges and Implications:

- Below 3: Generally indicates a stable market environment with lower risk.

- 3 to 6: Suggests caution as risks are rising, but not yet at extreme levels.

- Above 6: Indicates elevated risk, where corrections are more likely.

Common combinations include:

- Strong breadth + low volatility: Typically seen in healthy bull markets.

- Weak breadth + rising volatility: Often precedes market corrections or downturns.

- Defensive sectors leading: Can signal a shift towards risk aversion.

Real-World Scenarios – How This Shows Up in Markets

Scenario 1: Topping Environment

Imagine a scenario where major indices are grinding higher, but the % Above 50-DMA is declining. This suggests that fewer stocks are participating in the rally, a classic sign of a market top. Traders might be tempted to chase the rally, but a more informed view would recognize the underlying weakness and prepare for potential corrections.

Scenario 2: Bull Market Surge

In a strong new bull leg, the % Above 50-DMA surges and remains elevated. This indicates broad participation and strong market health. Traders can be more open to adding exposure, provided their setups align with the broader trend.

Scenario 3: Volatility Spike

During a volatility spike, ATR% jumps, and the CWI accelerates. This environment is often marked by sharp price movements and increased risk. Traders should consider reducing exposure and focusing on risk management.

How to Use This Insight in a Process

Practical guidelines for incorporating these insights include:

- When breadth is weak and CWI is high, emphasize defense and reduce new risk. This means tightening stops, reducing position sizes, and avoiding aggressive buying.

- When breadth and leadership broaden out, be more open to adding exposure if your setups are there. Ensure that your risk management rules are still in place.

- Use the Market Dashboard as a high-level regime label, then check internals for confirmation. This helps maintain a balanced view of the market.

Common Misuses & Misconceptions

Traders often misuse these metrics by:

- Treating them as stand-alone entry signals: Instead, use them as part of a broader risk management framework.

- Ignoring context: Consider sector rotation and time frames to avoid misinterpretations.

- Overreacting to one-day changes: Focus on trends and sustained movements rather than daily fluctuations.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: This article is for informational purposes only and does not constitute financial advice. Trading involves risk, and you should consult with a financial advisor before making any investment decisions.